Don’t be buying a plutonium fission reactor powering a flux capacitor to launch your DeLorean to manage your portfolio. Instead, take a moment to read this for a good summary of the past, present and maybe the future of markets.

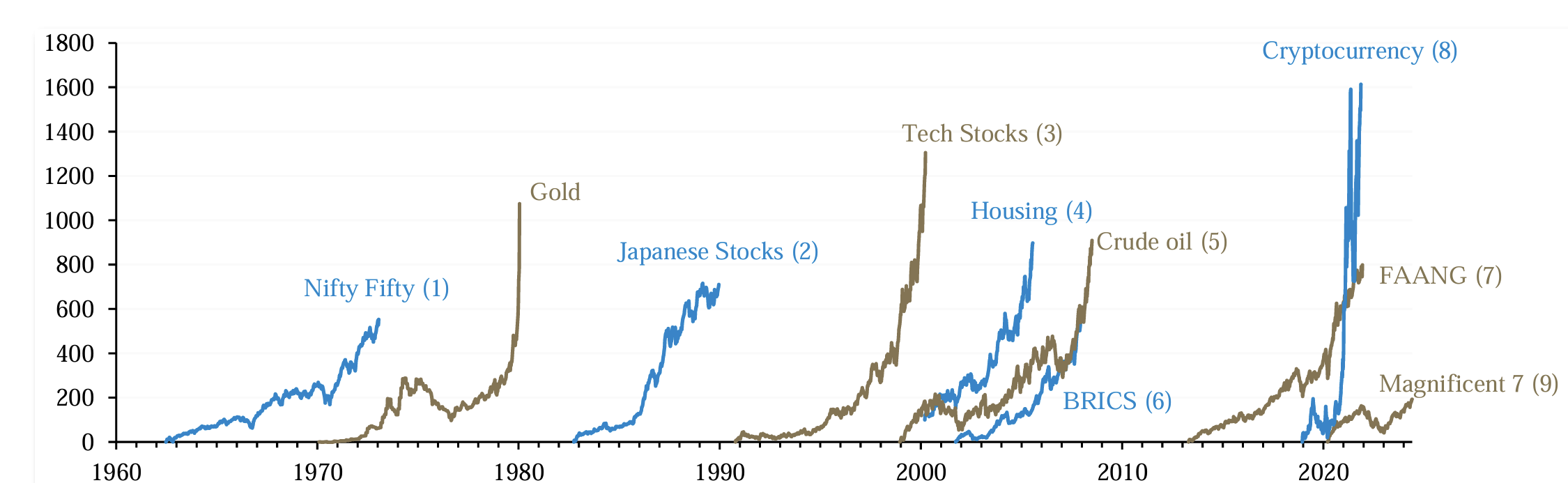

In the 1960s, markets were all about the “Nifty Fifty”, a group of US “blue chip” stocks, which included Coca-Cola, Disney, General Electric and IBM to name a few. This group was anticipated to generate outstanding returns in perpetuity — and commanded sky-high valuations in the marketplace as a result.

As inflation accelerated following years of loose fiscal and monetary policy, the US Federal Reserve raised interest rates sharply higher, which, combined with ensuing economic downturns, triggered a market collapse, with these previously perceived invincible stocks falling particularly hard.

Price pressures were exacerbated by international oil producers’ embargo against the US in the early 1970s that fueled a surge in commodity prices. Gold, historically viewed as a store of real purchasing power, saw particular strength that was compounded by the abandonment of the gold standard (where the price of gold was fixed to the US dollar) in 1971, which allowed the price of the yellow metal to be driven more by market forces rather than be artificially suppressed.

The expectations for ever-increasing prices, however, were dashed as historically high interest rates of the early 1980s finally quelled inflation and saw the opportunity cost of gold (which offers no cash flows) for investors surge, prompting it to rapidly fall out of favour.

The “economic miracle” underway in Japan in the 1980s stoked investor interest, resulting in substantial flows into equity markets — the market capitalization of the stocks on the Tokyo Stock Exchange eclipsed American markets in 1987 and accounted for 40% of world equity weight by 1989 despite the economy itself peaking at just under 9% of global production at that point in time. The tightening of monetary policy in Japan in 1989 proved the death knell for the boom and “Lost Decades” of economic stagnation followed.

Attention turned to US Tech stocks with the advent of the internet in the mid-1990s, with the mania driving valuations to stratospheric levels by the end of the decade for equities of still-thriving companies (such as Amazon, Cisco and Qualcomm) and others (Pets.com an oft-cited example) alike. Again, higher interest rates, as well as some high-profile business failures, forced an abrupt reassessment of markets and brought stock price multiples back to earth.

The low-interest rate environment of the 2000s and lax lending standards drove speculative fervour in US housing markets, while the rapid growth in Emerging Markets (spurred on by China opening its economy and joining the World Trade Organization in 2001) underpinned a rally in commodities and attracted significant investor flows into the markets of the newly coined “BRICS” (Brazil, Russia, India, China and South Africa). The credit crisis stateside and the resulting deep global recession brought an end to these rallies.

Tech-related areas of financial markets have again become the object of investors’ affection, though with respect to stocks, it has been considerably more discriminating — the short-lived crypto boom, and its historic gains, less so.

Unlike the period at the turn of the millennium when stocks were seemingly rewarded just for affixing “dot com” to their name, the focus has been on a narrow subset of established market leaders. The more consumer-focused “FAANG1” group first gained momentum a decade ago while the composition of the leaders shifted a bit more recently to the more artificial intelligence (AI) adjacent US mega-cap “Magnificent 72”, which have turned in strong performance in the face of higher interest rates that, as suggested by the above, typically are a precursor to less jubilant times for investors.

While the gains, like developments in AI and its integration into the broader economic system, would appear to be in their nascent stages, the purpose of the above history lesson is to emphasize that even when market trends prove to not simply be passing fancies, outperformance does not last forever and fortunes can turn quickly.

Financial markets are constantly changing, with different assets falling into and out of favour as macroeconomic, fiscal, monetary, and geopolitical conditions shift and evolve over time, and technological innovations periodically drive seismic changes in the way the world operates.

Accordingly, while investors can clearly benefit from catching on with long-term investment themes, it remains important to maintain discipline in the investment process so as to not let return expectations detach from the economic reality. Further, despite the concentrated performance of late, maintaining diversified holdings not only helps with respect to risk management but casts a wider net and can help ensure investors have some exposure to the next big thing that captures the markets’ imagination.

Changing investment themes

(percentage points)

All data have been inflation-adjusted using US consumer price index; (1) Proxied by average of Coca-Cola, Disney, General Electric and IBM; (2) Nikkei 225 Index in US dollar terms; (3) S&P 500 Information Technology Index; (4) S&P 500 Homebuilding Index; (5) West Texas Intermediate price; (6) market capitalization-weighted average of US dollar MSCI Indexes for Brazil, Russia, India, China, and South Africa; (7) market capitalization-weighted average of Meta (Facebook), Amazon, Apple, Netflix, and Alphabet (Google); (8) Bloomberg Galaxy Crypto Index; (9) market capitalization-weighted average of Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla; source: Guardian Capital based on data from Bloomberg and Macrotrends to May 16, 2024

- “FAANG” is an acronym that indicates the stocks of five prominent American technology companies: Facebook, Amazon, Apple, Netflix, and Alphabet (formerly Google). ↩︎

- Amazon.com, Apple, Alphabet, Meta, Microsoft, NVIDIA and Tesla. ↩︎

This commentary is for general informational purposes only and does not constitute investment, financial, legal, accounting, tax advice or a recommendation to buy, sell or hold a security. It shall under no circumstances be considered an offer or solicitation to deal in any product or security mentioned herein. It is only intended for the audience to whom it has been distributed and may not be reproduced or redistributed without the consent of Guardian Capital Advisors LP. This information is not intended for distribution into any jurisdiction where such distribution is restricted by law or regulation.

The opinions expressed are as of the published date and are subject to change without notice. Assumptions, opinions and estimates are provided for illustrative purposes only and are subject to significant limitations. Reliance upon this information is at the sole discretion of the reader. This document includes information and commentary concerning financial markets that was developed at a particular point in time. This information and commentary are subject to change at any time, without notice, and without update. This commentary may also include forward-looking statements concerning anticipated results, circumstances, and expectations regarding future events. Forward-looking statements require assumptions to be made and are, therefore, subject to inherent risks and uncertainties. There is significant risk that predictions and other forward-looking statements will not prove to be accurate. Investing involves risk. Equity markets are volatile and will increase and decrease in response to economic, political, regulatory and other developments. Investments in foreign securities involve certain risks that differ from the risks of investing in domestic securities. Adverse political, economic, social or other conditions in a foreign country may make the stocks of that country difficult or impossible to sell. It is more difficult to obtain reliable information about some foreign securities. The costs of investing in some foreign markets may be higher than investing in domestic markets. Investments in foreign securities also are subject to currency fluctuations. The risks and potential rewards are usually greater for small companies and companies located in emerging markets. Bond markets and fixed-income securities are sensitive to interest rate movements. Inflation, credit and default risks are also associated with fixed income securities. Diversification may not protect against market risk, and loss of principal may result. This commentary is provided for educational purposes only. It is not offered as investment advice and does not account for individual investment objectives, risk tolerance, financial situation or the timing of any transaction in any specific security or asset class. Certain information contained in this document has been obtained from external parties, which we believe to be reliable, however, we cannot guarantee its accuracy. These sources include Bloomberg, Bank of Canada and National Bank Independent Network for the relevant periods cited in this commentary. Guardian Capital Advisors LP provides private client investment services and is an indirect wholly owned subsidiary of Guardian Capital Group Limited, a publicly traded firm listed on the Toronto Stock Exchange. All trademarks, registered and unregistered, are owned by Guardian Capital Group Limited and are used under license.