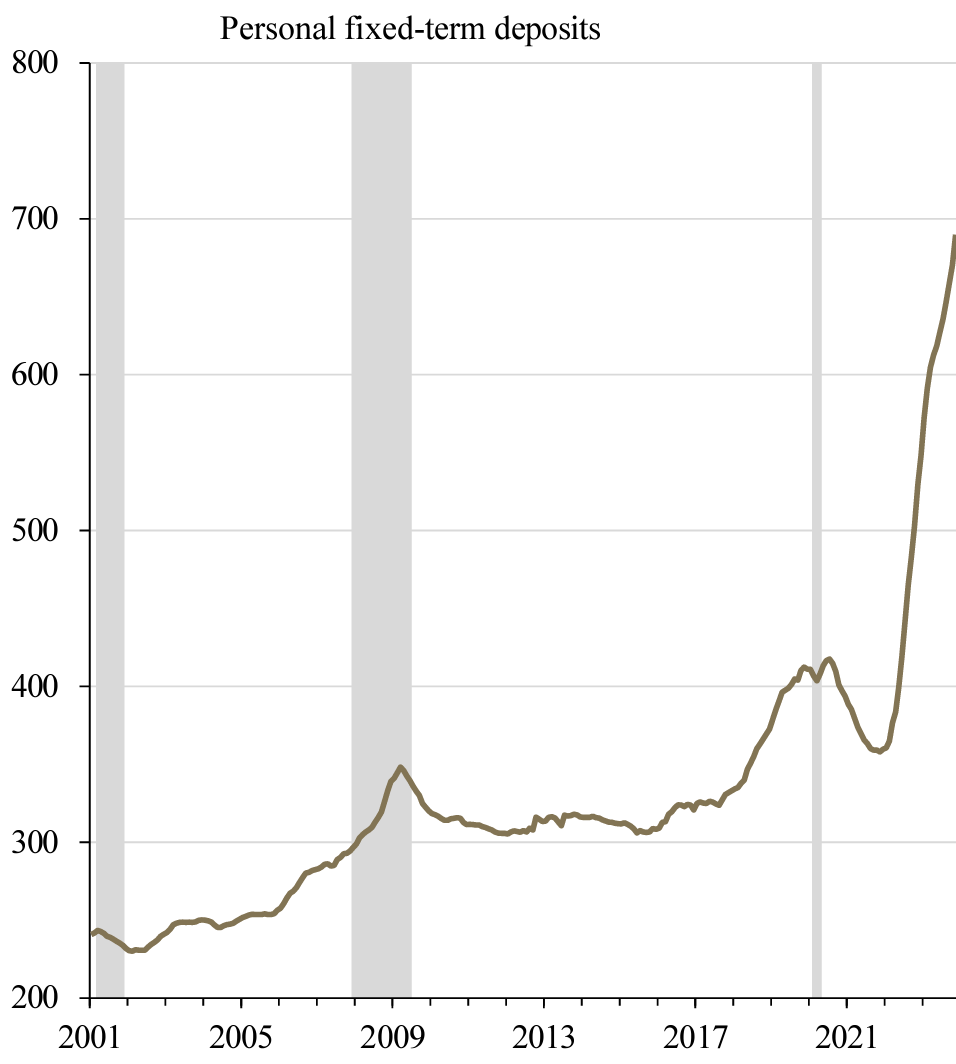

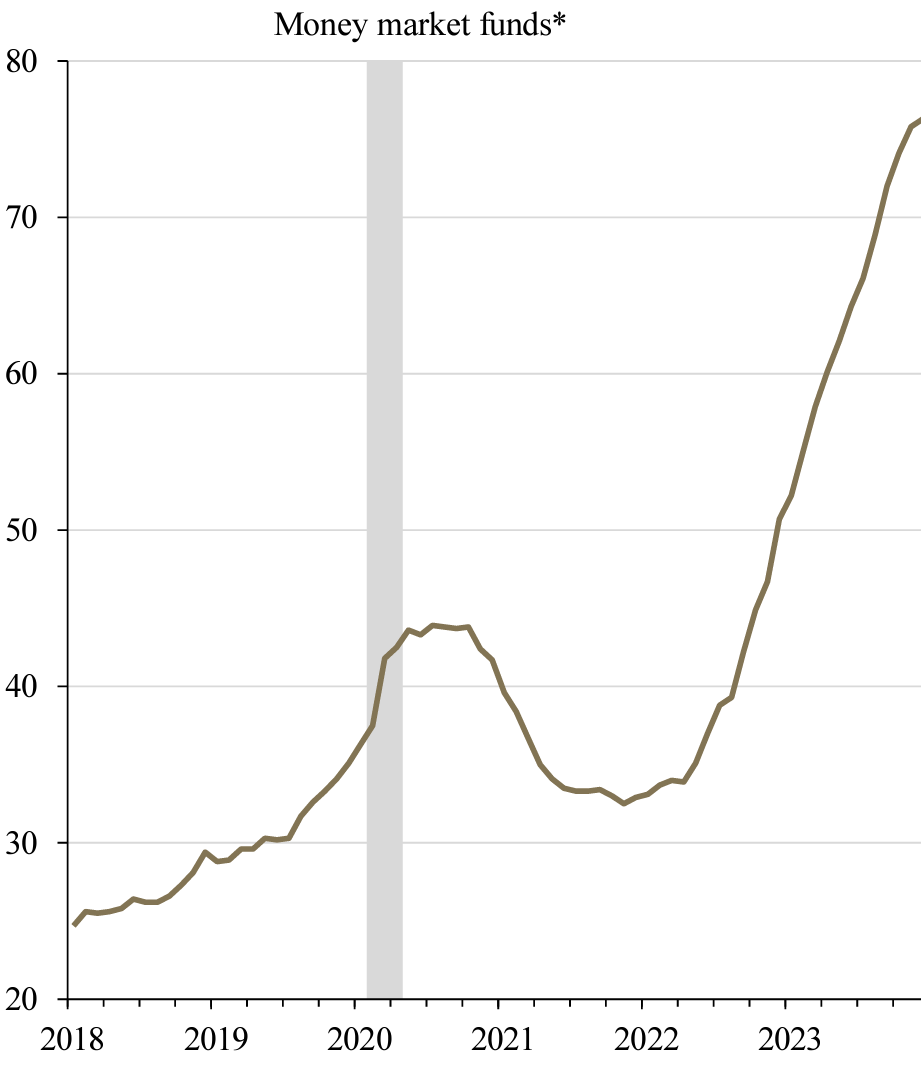

Money market funds have experienced a surge of inflows in recent years. These short-term investment vehicles have recorded more net sales in Canadian retail markets than all other asset classes combined over the last two years. This has resulted in net assets under management more than doubling since the end of 2021 to C$76 billion. Personal fixed-term deposits at banks, including guaranteed investment certificates (GIC), have almost doubled as well over that same period — an increase of a whopping C$330 billion to almost C$700 billion.

A cache of cash

(Personal fixed-term deposits and money market fund* net assets, Canada; billions of Canadian dollars)

*Domestic mutual funds & exchange-traded funds; shaded regions represent periods of US recession; source: Guardian Capital based on data from the Investment Funds Institute of Canada and the Bank of Canada to December 2023

Heightened uncertainty and volatility in the marketplace have increased the appeal of a safe place to stash cash. A larger driver of this near-unprecedented flood of money into cash & equivalents, however, has been the sharp increase in market interest rates that actually makes the asset class compelling from a return perspective for the first time in many investors’ adult lives.

Indeed, the 4.7% total return on cash (as proxied by the FTSE Canada 91-Day Treasury Bill Index) last year represented the asset class’ best calendar performance in 22-years — and while the outsized rally across financial markets in the final two months of 2023 resulted in it lagging the returns on domestic equities (S&P/TSX Composite Index +11.8% total return) and bonds (FTSE Canada Universe Bond Index +6.7%), its cumulative 6.6% return over the last two years outpaced the other asset classes (S&P/TSX +5.2% total return over the same period; -5.8% for the broad Canadian bond index) while having to endure effectively none of their volatility.

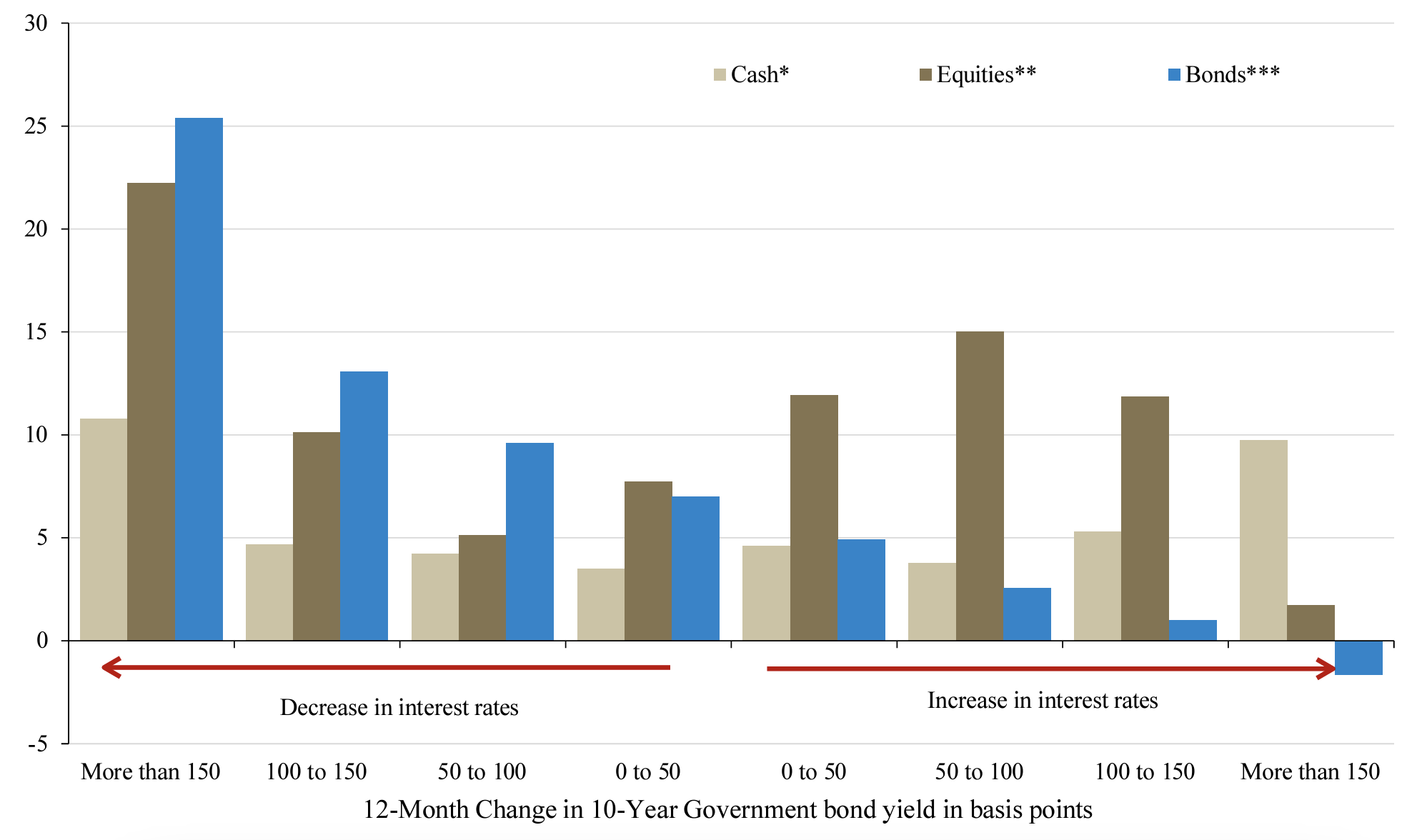

Interestingly, this cash outperformance as market interest rates surged (the 10-year Government of Canada note yield increased by 168 basis points over the two-years ended December 31, 2023) is not a historical anomaly. It is actually the norm in these market conditions as data covering more than four decades show that cash is the top-performing asset class on average when rates rise by at least 150 basis points (a top 10 percentile move).

On a sliding scale

(Asset class 12-month average total return by change in rates; percent) class on average when rates rise by at least 150 basis points (a top 10 percentile move).

*Cash=FTSE Canada 91-Day T-Bill Index; **Stocks=S&P/TSX Composite Index; ***Bond=FTSE Canada Universe Bond Index; source: Guardian Capital based on data from Bloomberg and PC Bond from January 1979 to December 2023.

It is, however, only in these extreme market scenarios where cash has historically been the best option for investors. In periods of more modest increases in interest rates — which typically coincide with an upswing in the market cycle in which growth and inflation are rising, increasing the anticipation of central bank rate increases — equities are the top performer on average. The same holds true when rates stay roughly flat. Periods of declining rates — which typically coincide with more down economic outlooks that presage central banks easing policy — see bonds outperform.

Looking to the months ahead, central banks are broadly expected to begin cutting rates as progress on getting inflation back within the realm of “normal” allows policymakers to return to a more “neutral” setting as they try to navigate a “soft landing.” While the timing and magnitude of cuts is going to a matter for debate, there is an overwhelming consensus on the direction (barring some sort of inflationary shock that spurs central banks into further action).

The prospect of lower interest rates would mean lower returns and increased reinvestment risk, which make the case for cash less compelling relative to other asset classes that have historically fared better in more benign interest rate environments — and any redeployment of that cache of cash (which is equivalent to roughly 25% of the total Canadian equity market capitalization) would certainly provide a lift to other asset classes.

While the outlook remains uncertain, it would appear investors who find themselves sitting on an abundance of cash could improve their longer-term financial health by adding investments that fare well in more “normal” interest rate environments to portfolios — namely, assets such as equities and longer-dated bonds that derive more of their value from their future prospective cash flows rather than current payments as their price goes up as interest rates go down, all else the same.

It is a pivotal time to consider having a discussion with your financial advisor about your investments.

This commentary is for general informational purposes only and does not constitute investment, financial, legal, accounting, tax advice or a recommendation to buy, sell or hold a security. It shall under no circumstances be considered an offer or solicitation to deal in any product or security mentioned herein. It is only intended for the audience to whom it has been distributed and may not be reproduced or redistributed without the consent of Guardian Capital Advisors LP. This information is not intended for distribution into any jurisdiction where such distribution is restricted by law or regulation.

The opinions expressed are as of the published date and are subject to change without notice. Assumptions, opinions and estimates are provided for illustrative purposes only and are subject to significant limitations. Reliance upon this information is at the sole discretion of the reader. This document includes information and commentary concerning financial markets that was developed at a particular point in time. This information and commentary are subject to change at any time, without notice, and without update. This commentary may also include forward-looking statements concerning anticipated results, circumstances, and expectations regarding future events. Forward-looking statements require assumptions to be made and are, therefore, subject to inherent risks and uncertainties. There is significant risk that predictions and other forward-looking statements will not prove to be accurate. Investing involves risk. Equity markets are volatile and will increase and decrease in response to economic, political, regulatory and other developments. Investments in foreign securities involve certain risks that differ from the risks of investing in domestic securities. Adverse political, economic, social or other conditions in a foreign country may make the stocks of that country difficult or impossible to sell. It is more difficult to obtain reliable information about some foreign securities. The costs of investing in some foreign markets may be higher than investing in domestic markets. Investments in foreign securities also are subject to currency fluctuations. The risks and potential rewards are usually greater for small companies and companies located in emerging markets. Bond markets and fixed-income securities are sensitive to interest rate movements. Inflation, credit and default risks are also associated with fixed income securities. Diversification may not protect against market risk, and loss of principal may result. This commentary is provided for educational purposes only. It is not offered as investment advice and does not account for individual investment objectives, risk tolerance, financial situation or the timing of any transaction in any specific security or asset class. Certain information contained in this document has been obtained from external parties, which we believe to be reliable, however, we cannot guarantee its accuracy. These sources include Bloomberg, Bank of Canada and National Bank Independent Network for the relevant periods cited in this commentary. Guardian Capital Advisors LP provides private client investment services and is an indirect wholly owned subsidiary of Guardian Capital Group Limited, a publicly traded firm listed on the Toronto Stock Exchange. All trademarks, registered and unregistered, are owned by Guardian Capital Group Limited and are used under license.