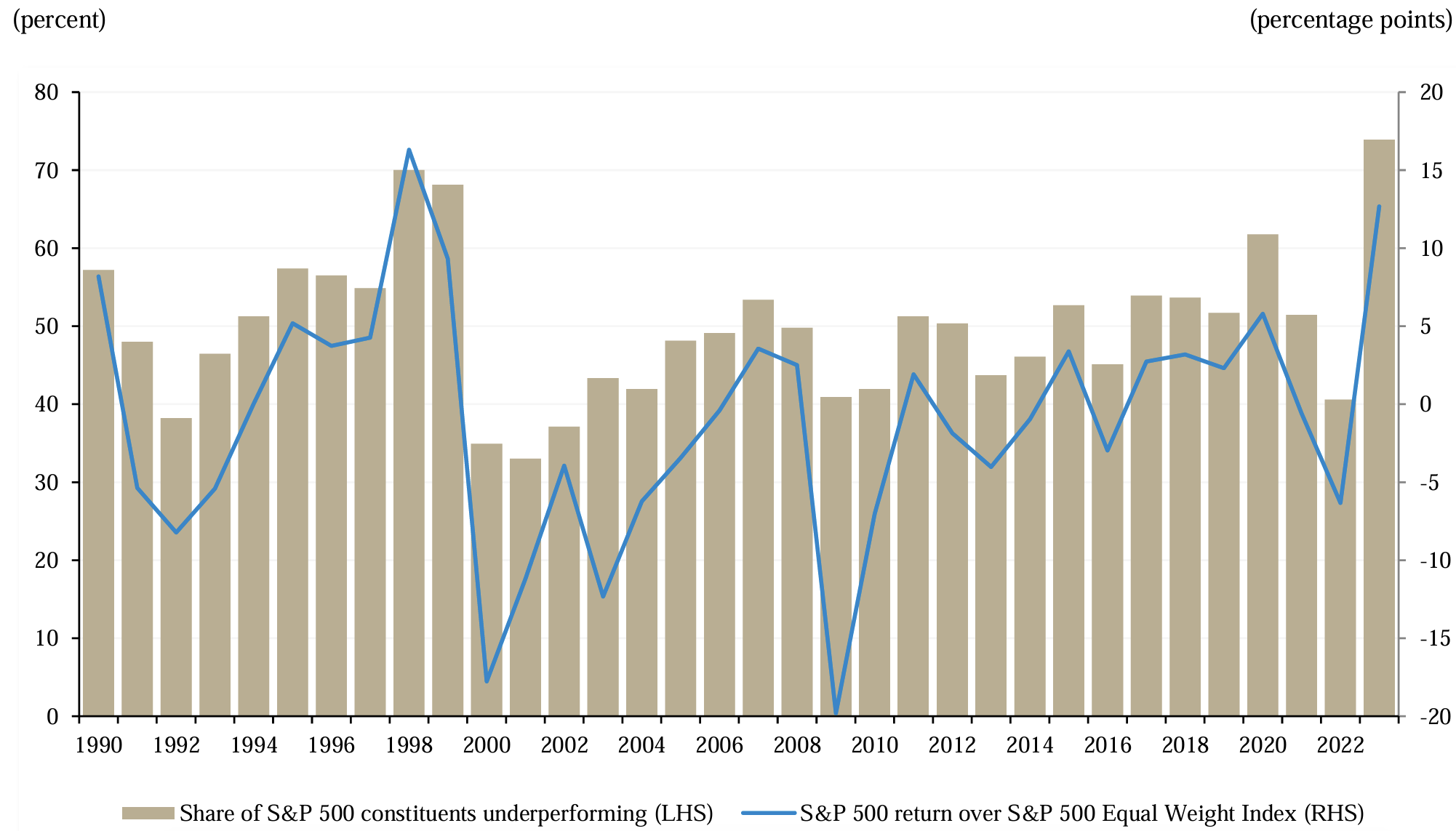

It is notoriously difficult to beat the performance of broad equity market benchmarks, and keeping up with the market becomes even more difficult when performance is narrow rather than broad. In a situation where returns are driven by just a handful of stocks, any portfolio that does not have exposure to those names or has a relative underweight position versus the benchmark, is more likely to underperform the market in the short term. Bear in mind that outperformance for active ETF’s is not much different and passive ETF’s substantially underperform indices over time due to fees.

It is not a coincidence that roughly 75%1 of global fund managers underperformed the broad S&P Global 1200 Index2 last year when leadership was concentrated among a historically narrow subset of large US Tech-adjacent companies. Nearly 90%3 of global fund managers have lagged the benchmark over the last three years of “Magnificent Seven4” dominance. In times of narrow markets, investors have a tendency to pivot into funds that would capture the exposure afforded by a narrow market.

Historically, when an inflection point occurs, and a broader market begins to take shape – more securities add value to the overall performance of the benchmark. As market conditions normalize and performance broadens, active managers tend to fare much better. The question, therefore, is: has anything materially changed since the start of the year that warrants a rethink of the outlook and any related investment thesis? The answer is: not yet.

For example, equal-weighted equity indices (one where all the securities have the same weight or influence) are considered to be better benchmarks for actively managed portfolios. In fact, research5 shows that the S&P 500 Equal-Weight Index historically outperformed its market capitalization-weighted counterpart (the widely quoted S&P 500). By extension, for long-term investors, quality active managers would have a performance advantage over passive investing.

In summary, when fewer stocks outperform the index (narrow leadership), passive investments are likely to do better than active managers; when a greater share of stocks better the index, active management tends to do better. Moreover, active management can offer risk management benefits by avoiding large allocations to stocks that have run up significantly in price – an unintended consequence of some passive investments during periods of narrow market leadership.

While it may be the case that extremely concentrated gains within global stock markets in recent years can have investors questioning whether taking an active approach to investing is worthwhile, market history shows that keeping a narrow mind will adversely impact investors when market conditions shift and ultimately see a broadening of market leadership.

Share of S&P 500 constituents underperforming S&P 500 and S&P 500 return relative to S&P 500 Equal Weight Index

Source: Guardian Capital based on data from S&P Global, Apollo Global Management and Bloomberg to December 31, 2023

- SPIVA U.S. Scorecard Year-End 2023 (spglobal.com), Exhibit 8 (Page 9) ↩︎

- The S&P Global 1200 Index is a market-capitalization weighted composite index, comprised of seven regional and country indices: S&P 500, S&P Europe 350, S&P/TOPIX 150 (Japan), S&P TSX 60 (Canada), S&P/ASX 50 (Australia), S&P Asia 50 and S&P Latin America 40. ↩︎

- SPIVA U.S. Scorecard Year-End 2023 (spglobal.com), Report 6a (Page 21) ↩︎

- “Magnificent Seven”=Alphabet, Amazon, Apple, Meta, Microsoft, NVIDIA, and Tesla ↩︎

- More Equal than Others: 20 Years of the S&P 500 Equal Weight Index (spglobal.com) ↩︎

This commentary is for general informational purposes only and does not constitute investment, financial, legal, accounting, tax advice or a recommendation to buy, sell or hold a security. It shall under no circumstances be considered an offer or solicitation to deal in any product or security mentioned herein. It is only intended for the audience to whom it has been distributed and may not be reproduced or redistributed without the consent of Guardian Capital Advisors LP. This information is not intended for distribution into any jurisdiction where such distribution is restricted by law or regulation.

The opinions expressed are as of the published date and are subject to change without notice. Assumptions, opinions and estimates are provided for illustrative purposes only and are subject to significant limitations. Reliance upon this information is at the sole discretion of the reader. This document includes information and commentary concerning financial markets that was developed at a particular point in time. This information and commentary are subject to change at any time, without notice, and without update. This commentary may also include forward-looking statements concerning anticipated results, circumstances, and expectations regarding future events. Forward-looking statements require assumptions to be made and are, therefore, subject to inherent risks and uncertainties. There is significant risk that predictions and other forward-looking statements will not prove to be accurate. Investing involves risk. Equity markets are volatile and will increase and decrease in response to economic, political, regulatory and other developments. Investments in foreign securities involve certain risks that differ from the risks of investing in domestic securities. Adverse political, economic, social or other conditions in a foreign country may make the stocks of that country difficult or impossible to sell. It is more difficult to obtain reliable information about some foreign securities. The costs of investing in some foreign markets may be higher than investing in domestic markets. Investments in foreign securities also are subject to currency fluctuations. The risks and potential rewards are usually greater for small companies and companies located in emerging markets. Bond markets and fixed-income securities are sensitive to interest rate movements. Inflation, credit and default risks are also associated with fixed income securities. Diversification may not protect against market risk, and loss of principal may result. This commentary is provided for educational purposes only. It is not offered as investment advice and does not account for individual investment objectives, risk tolerance, financial situation or the timing of any transaction in any specific security or asset class. Certain information contained in this document has been obtained from external parties, which we believe to be reliable, however, we cannot guarantee its accuracy. These sources include Bloomberg, Bank of Canada and National Bank Independent Network for the relevant periods cited in this commentary. Guardian Capital Advisors LP provides private client investment services and is an indirect wholly owned subsidiary of Guardian Capital Group Limited, a publicly traded firm listed on the Toronto Stock Exchange. All trademarks, registered and unregistered, are owned by Guardian Capital Group Limited and are used under license.