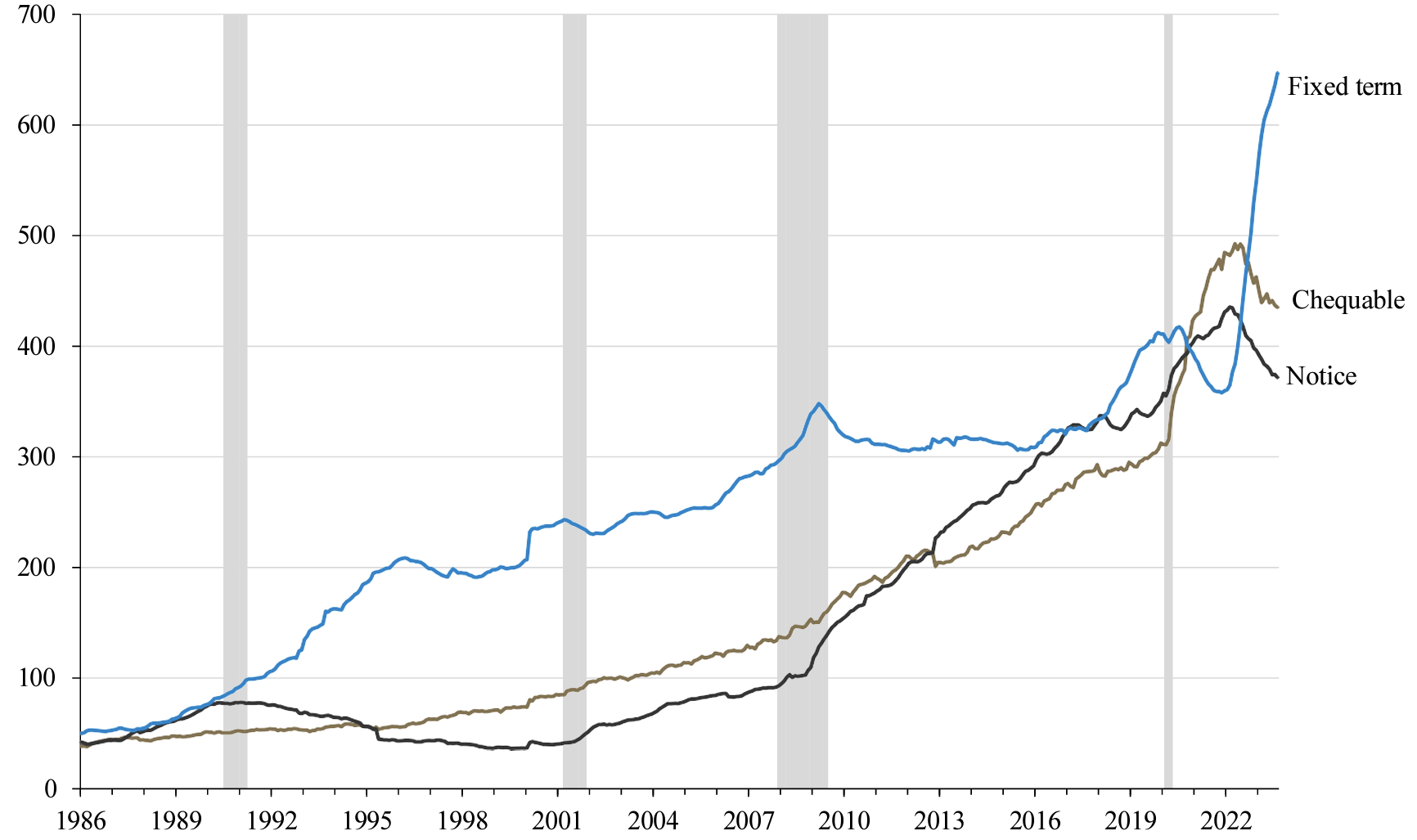

A key factor in the resiliency of the consumer has been the accumulation of personal savings. Statistics Canada’s National Balance Sheet Accounts data indicated that Canadian households held a total of C$2.06 trillion in currency and deposits at the end of Q1 2023 – a new record. Within these excess savings, there has been a significant spike in fixed-term deposits (i.e., GICs), which currently stand at C$647 billion – also a new record.

Personal deposits at Canadian chartered banks by type

(billions of Canadian dollars)

Source: Guardian Capital based on data from the Bank of Canada to August 2023

While it’s sensible for investors to lock in at some of the highest interest rates we’ve seen in decades (at least for a portion of their portfolio), we believe there are some important points to consider.

For one, there is an adage that while you should not let the “tax tail wag the dog”, you should be aware of the tax impact of your investments. High-income earners who hold GICs in non-registered accounts will see half of their returns go to tax. So, while the headline return is attractive, the after-tax return is just keeping up with inflation, at best. Alternatively, shorter-term bonds that are currently being sold at a discount will produce capital gains, which will enhance the after-tax return.

Another consideration is the potential opportunity cost of locking in capital. For this reason, investors may want to consider short-term instruments that don’t have lock-in periods so they can quickly take advantage of the prevailing market environment.

For example, while the expectation of “higher for longer” is the consensus view, central banks appear poised to halt or at least slow the series of rate hikes they started in 2022. Should a rate-cutting cycle begin, investors will want the flexibility to shift from short rates to longer-dated bonds (longer-duration bonds), which will likely outperform short- term instruments in this scenario.

And despite the challenges over the last year and a half, equities remain one of the best ways to grow capital over time and protect against inflation. The ability to quickly move out of short-term investments can be a great way to take advantage of equity volatility. For investors with significant cash on the sidelines, utilizing a liquid short-term investment can be an excellent way to “average in” to the market and set up their portfolios for long-term success.

If you would like to learn more about how you can flexibly take advantage of today’s attractive short-term rates, please reach out to your Client Portfolio Manager.

This commentary is for general informational purposes only and does not constitute investment, financial, legal, accounting, tax advice or a recommendation to buy, sell or hold a security. It shall under no circumstances be considered an offer or solicitation to deal in any product or security mentioned herein. It is only intended for the audience to whom it has been distributed and may not be reproduced or redistributed without the consent of Guardian Capital Advisors LP. This information is not intended for distribution into any jurisdiction where such distribution is restricted by law or regulation.

The opinions expressed are as of the published date and are subject to change without notice. Assumptions, opinions and estimates are provided for illustrative purposes only and are subject to significant limitations. Reliance upon this information is at the sole discretion of the reader. This document includes information and commentary concerning financial markets that was developed at a particular point in time. This information and commentary are subject to change at any time, without notice, and without update. This commentary may also include forward-looking statements concerning anticipated results, circumstances, and expectations regarding future events. Forward-looking statements require assumptions to be made and are, therefore, subject to inherent risks and uncertainties. There is significant risk that predictions and other forward-looking statements will not prove to be accurate. Investing involves risk. Equity markets are volatile and will increase and decrease in response to economic, political, regulatory and other developments. Investments in foreign securities involve certain risks that differ from the risks of investing in domestic securities. Adverse political, economic, social or other conditions in a foreign country may make the stocks of that country difficult or impossible to sell. It is more difficult to obtain reliable information about some foreign securities. The costs of investing in some foreign markets may be higher than investing in domestic markets. Investments in foreign securities also are subject to currency fluctuations. The risks and potential rewards are usually greater for small companies and companies located in emerging markets. Bond markets and fixed-income securities are sensitive to interest rate movements. Inflation, credit and default risks are also associated with fixed income securities. Diversification may not protect against market risk, and loss of principal may result. This commentary is provided for educational purposes only. It is not offered as investment advice and does not account for individual investment objectives, risk tolerance, financial situation or the timing of any transaction in any specific security or asset class. Certain information contained in this document has been obtained from external parties, which we believe to be reliable, however, we cannot guarantee its accuracy. These sources include Bloomberg, Bank of Canada and National Bank Independent Network for the relevant periods cited in this commentary. Guardian Capital Advisors LP provides private client investment services and is an indirect wholly owned subsidiary of Guardian Capital Group Limited, a publicly traded firm listed on the Toronto Stock Exchange. All trademarks, registered and unregistered, are owned by Guardian Capital Group Limited and are used under license.