One of the goals of putting idle (i.e., not needed right now) money into financial markets is to generate a return that, at minimum, retains the purchasing power of that capital in the future. Due to the tendency for prices to rise over time, it is unlikely that one dollar placed under a mattress today will be able to buy the same amount of goods and services in a year.

Thus, this need to compensate investors for the lost “real” value of money due to inflation is a key underpinning of the incentive structure of financial markets. After all, why would anyone invest if they ultimately end up worse off in inflation-adjusted terms?

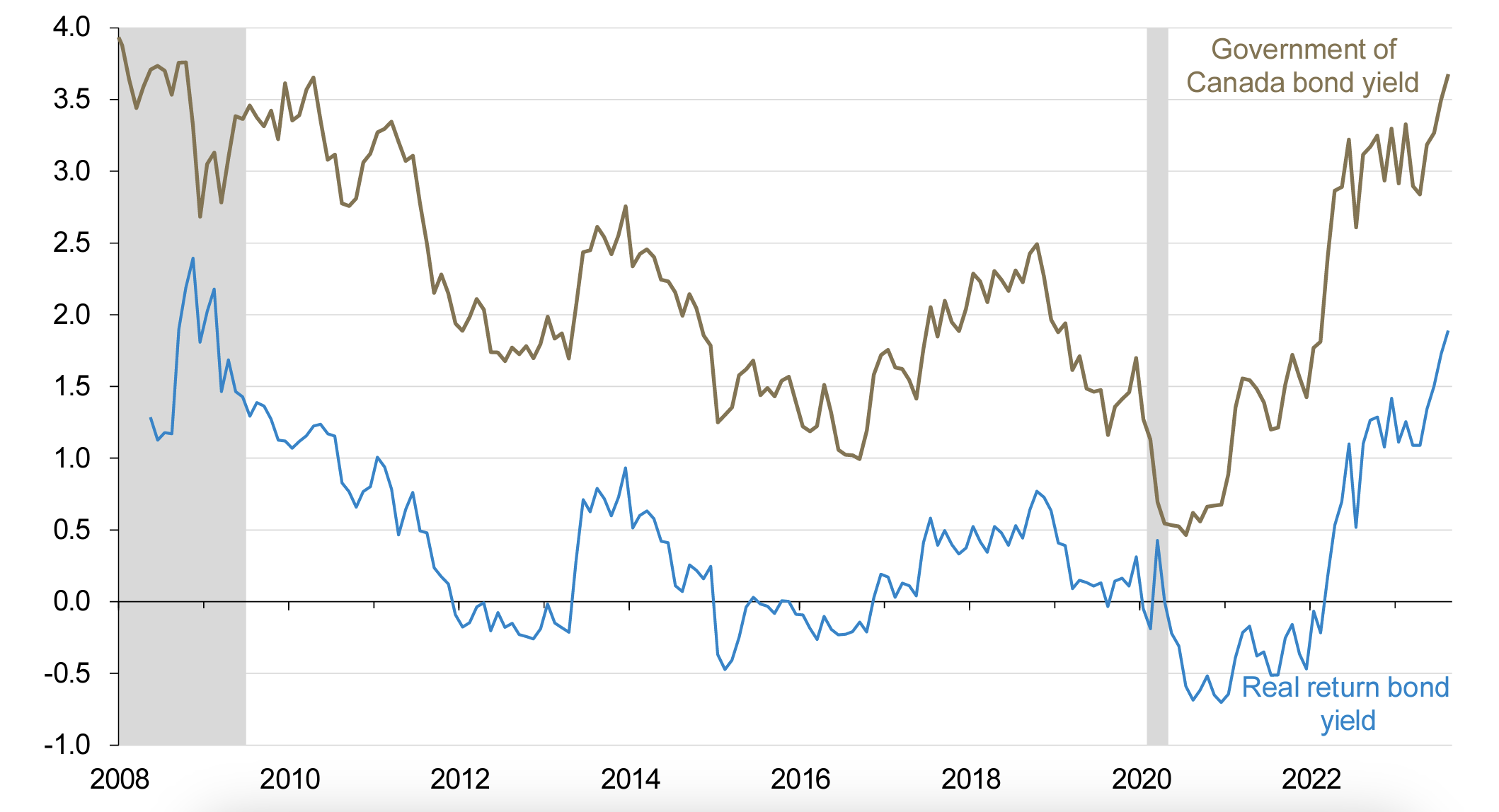

For much of the last decade, central banks’ zero interest rate policies and intervention in financial markets have kept bond yields at historically low levels. While Canada did not see negative nominal yields like in Europe and Japan, rates were still below (both actual and expected) inflation, which meant that real yields were less than zero (the average yield on a 10-year Government of Canada real return bond was -0.45% for the decade ended December 2022).

Bonds offer real value again

(10-year bond yield; percent)

Shaded regions represent periods of US recession; source: Guardian Capital based on data from Bloomberg to August 28, 2023

Negative real yields on government bonds meant that these safe investments were guaranteed to lose real value if held to maturity and, as a result, investors were forced out into riskier segments of the market (such as equities and lower credit quality bonds) to have any prospect of making adequate returns accounting for inflation over their investment horizons.

The aggressive shift from central banks over the last year in the face of multi-decade high price pressures, however, has spurred on a sharp increase in rates that, combined with normalizing longer-term inflation expectations, has seen real yields move meaningfully into positive territory and touch their highest levels since 2009.

While there are clear negatives to this development — borrowing has become more expensive, just ask anybody that has had to renew their mortgage recently — it is beneficial for savers since it means there are more opportunities to earn an adequate return on cash while taking on less risk.

What this means is that for the first time in the adult lives of the millennial generation — and the higher income earning and investing years of older cohorts — there actually is a real alternative to stocks when it comes to saving for the future.

Accordingly, this represents an important opportunity to review investment portfolios with a particular focus on risk exposures that have likely drifted higher over time. Fixed income assets that have often been overlooked by investors now offer compelling risk/reward trade-offs while also providing the added value of a diversifier in balanced portfolios.

This commentary is for general informational purposes only and does not constitute investment, financial, legal, accounting, tax advice or a recommendation to buy, sell or hold a security. It shall under no circumstances be considered an offer or solicitation to deal in any product or security mentioned herein. It is only intended for the audience to whom it has been distributed and may not be reproduced or redistributed without the consent of Guardian Capital Advisors LP. This information is not intended for distribution into any jurisdiction where such distribution is restricted by law or regulation.

The opinions expressed are as of the published date and are subject to change without notice. Assumptions, opinions and estimates are provided for illustrative purposes only and are subject to significant limitations. Reliance upon this information is at the sole discretion of the reader. This document includes information and commentary concerning financial markets that was developed at a particular point in time. This information and commentary are subject to change at any time, without notice, and without update. This commentary may also include forward-looking statements concerning anticipated results, circumstances, and expectations regarding future events. Forward-looking statements require assumptions to be made and are, therefore, subject to inherent risks and uncertainties. There is significant risk that predictions and other forward-looking statements will not prove to be accurate. Investing involves risk. Equity markets are volatile and will increase and decrease in response to economic, political, regulatory and other developments. Investments in foreign securities involve certain risks that differ from the risks of investing in domestic securities. Adverse political, economic, social or other conditions in a foreign country may make the stocks of that country difficult or impossible to sell. It is more difficult to obtain reliable information about some foreign securities. The costs of investing in some foreign markets may be higher than investing in domestic markets. Investments in foreign securities also are subject to currency fluctuations. The risks and potential rewards are usually greater for small companies and companies located in emerging markets. Bond markets and fixed-income securities are sensitive to interest rate movements. Inflation, credit and default risks are also associated with fixed income securities. Diversification may not protect against market risk, and loss of principal may result. This commentary is provided for educational purposes only. It is not offered as investment advice and does not account for individual investment objectives, risk tolerance, financial situation or the timing of any transaction in any specific security or asset class. Certain information contained in this document has been obtained from external parties, which we believe to be reliable, however, we cannot guarantee its accuracy. These sources include Bloomberg, Bank of Canada and National Bank Independent Network for the relevant periods cited in this commentary. Guardian Capital Advisors LP provides private client investment services and is an indirect wholly owned subsidiary of Guardian Capital Group Limited, a publicly traded firm listed on the Toronto Stock Exchange. All trademarks, registered and unregistered, are owned by Guardian Capital Group Limited and are used under license.