One of the more fascinating things about stock markets is how much they can move on a daily basis despite how little the underlying fundamentals, specifically the financial health of the underlying company, change on a day-to-day basis. The reason is that the fundamentals are only part of the story. The rest of the value is derived from its prospects in the future, the assessments of which are far more subjective and fickle.

To put it in more technical terms, the value of an equity is a function of the economic reality (i.e., corporate profitability) and perceptions of the future (i.e., valuation). Given that economic reality tends to change periodically, perhaps with earnings announcements, it stands to reason that the main determinant of price movements is most likely changes in valuation.

The breakdown of performance data for the S&P 500 Index over the last seven decades shows that over short time horizons, valuations (price-to-earnings) are effectively the sole driver of returns, with optimism pushing valuations higher and generating gains, while pessimism detracts.

Breakdown of drivers of S&P 500 returns over different time horizons

| Investment horizon (months) | % contribution of price return* (Earnings) | % contribution of price return* (Price-to-Earnings) |

|---|---|---|

| 1 | 2 | 98 |

| 3 | 14 | 86 |

| 6 | 26 | 74 |

| 12 | 34 | 66 |

| 24 | 56 | 44 |

| 36 | 57 | 43 |

| 60 | 61 | 39 |

| 120 | 77 | 23 |

However, as the duration of investment lengthens, the shifts in perception about the future become less important and cede performance leadership to the fundamentals (aka earnings), and the added contribution from valuations only really comes when multiples are skewed toward extremes (highs or lows).

In other words, the key to successful long-term investing is to buy and hold equity in high-quality companies that can generate sustained, above-average earnings growth that is reasonably valued.

Not a new or revolutionary approach to building wealth, but one that requires the farsightedness and discipline to look past the short-term ebbs and flows of markets.

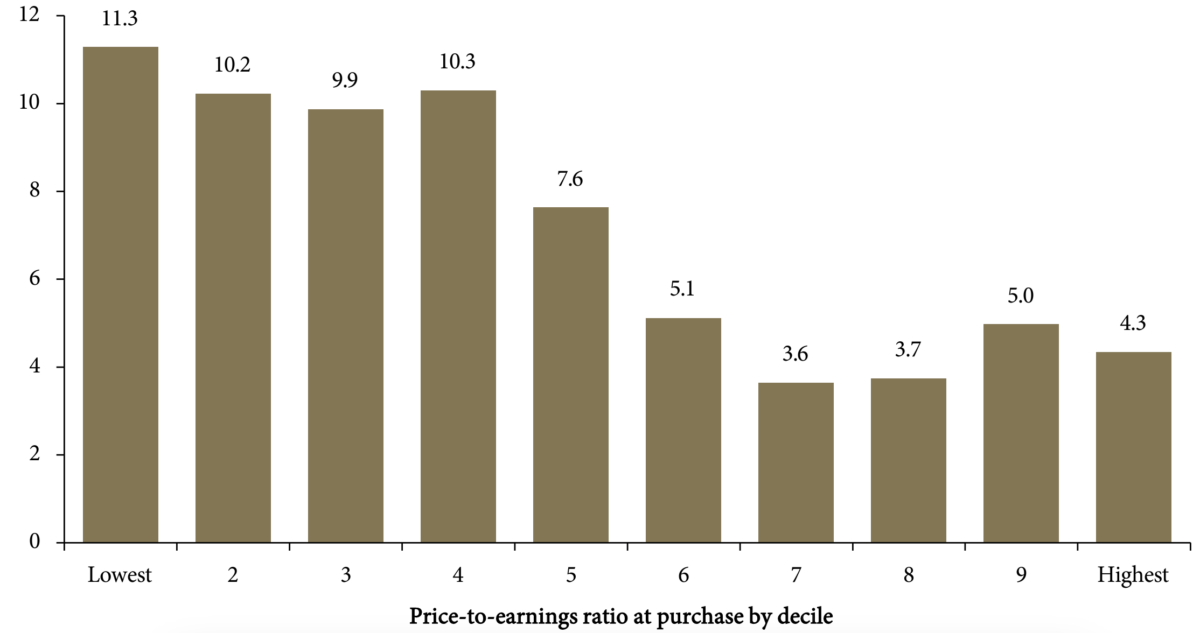

S&P 500 10-year forward price return by valuation at purchase

(annualized percent)

Source: Guardian Capital based on data from Bloomberg from January 1954 to April 2023

The opinions expressed are as of the published date and are subject to change without notice. Assumptions, opinions and estimates are provided for illustrative purposes only and are subject to significant limitations. Reliance upon this information is at the sole discretion of the reader. This document includes information and commentary concerning financial markets that was developed at a particular point in time. This information and commentary are subject to change at any time, without notice, and without update. This commentary may also include forward-looking statements concerning anticipated results, circumstances, and expectations regarding future events. Forward-looking statements require assumptions to be made and are, therefore, subject to inherent risks and uncertainties. There is significant risk that predictions and other forward-looking statements will not prove to be accurate. Investing involves risk. Equity markets are volatile and will increase and decrease in response to economic, political, regulatory and other developments. Investments in foreign securities involve certain risks that differ from the risks of investing in domestic securities. Adverse political, economic, social or other conditions in a foreign country may make the stocks of that country difficult or impossible to sell. It is more difficult to obtain reliable information about some foreign securities. The costs of investing in some foreign markets may be higher than investing in domestic markets. Investments in foreign securities also are subject to currency fluctuations. The risks and potential rewards are usually greater for small companies and companies located in emerging markets. Bond markets and fixed-income securities are sensitive to interest rate movements. Inflation, credit and default risks are also associated with fixed income securities. Diversification may not protect against market risk, and loss of principal may result. This commentary is provided for educational purposes only. It is not offered as investment advice and does not account for individual investment objectives, risk tolerance, financial situation or the timing of any transaction in any specific security or asset class. Certain information contained in this document has been obtained from external parties, which we believe to be reliable, however, we cannot guarantee its accuracy. These sources include Bloomberg, Bank of Canada and National Bank Independent Network for the relevant periods cited in this commentary. Guardian Capital Advisors LP provides private client investment services and is an indirect subsidiary of Guardian Capital Group Limited, a publicly traded firm listed on the Toronto Stock Exchange. All trademarks, registered and unregistered, are owned by Guardian Capital Group Limited and are used under license.