Investors could not really be blamed for eschewing a focus on risk management in their investment portfolios over the last decade, as the pre-pandemic backdrop of persistent growth, low inflation and zero interest rates supported consistently strong returns with muted volatility. Allocating money to bonds, an investment that served as a volatility buffer and offered little by way of return prospects given the meagre yield on offer, effectively just meant leaving money on the table.

Even as the market environment turned significantly more challenging following the onset of the pandemic, the argument for managing risk with diversified asset mixes did not hold much water.

The early weakness proved short-lived, and equities quickly resumed their hefty outperformance over bonds throughout 2020 and 2021 (the global fixed income benchmark actually turned in what was then its worst performance in 22 years in 2021).

Moreover, the notable “risk off” tone to stock markets over the last 12 months — arguably the very scenario in which holding safe, income-generating fixed income securities is supposed to be the most beneficial to portfolios — was largely the result of the sharp upward adjustment in interest rates driven by aggressive policy tightening by central banks in the name of stemming the tide of inflation. So rather than bond holdings providing an offset to equity declines, stocks and bonds marched in step lower, and correlations between asset classes surged to quarter-century highs.

Ritual beatings

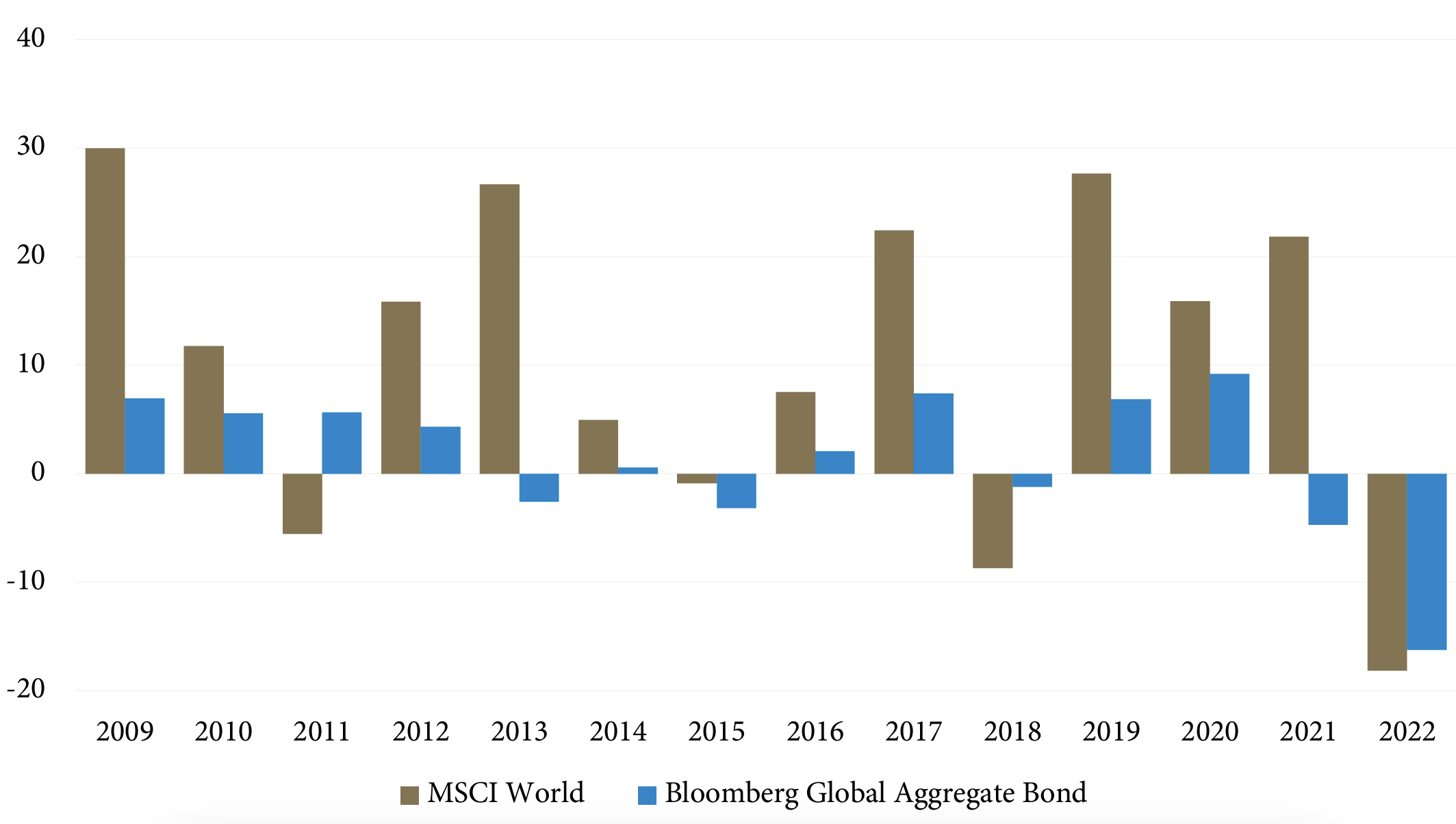

(calendar year total return; percent, US dollar basis)

Source: Guardian Capital based on data from Bloomberg to December 2022

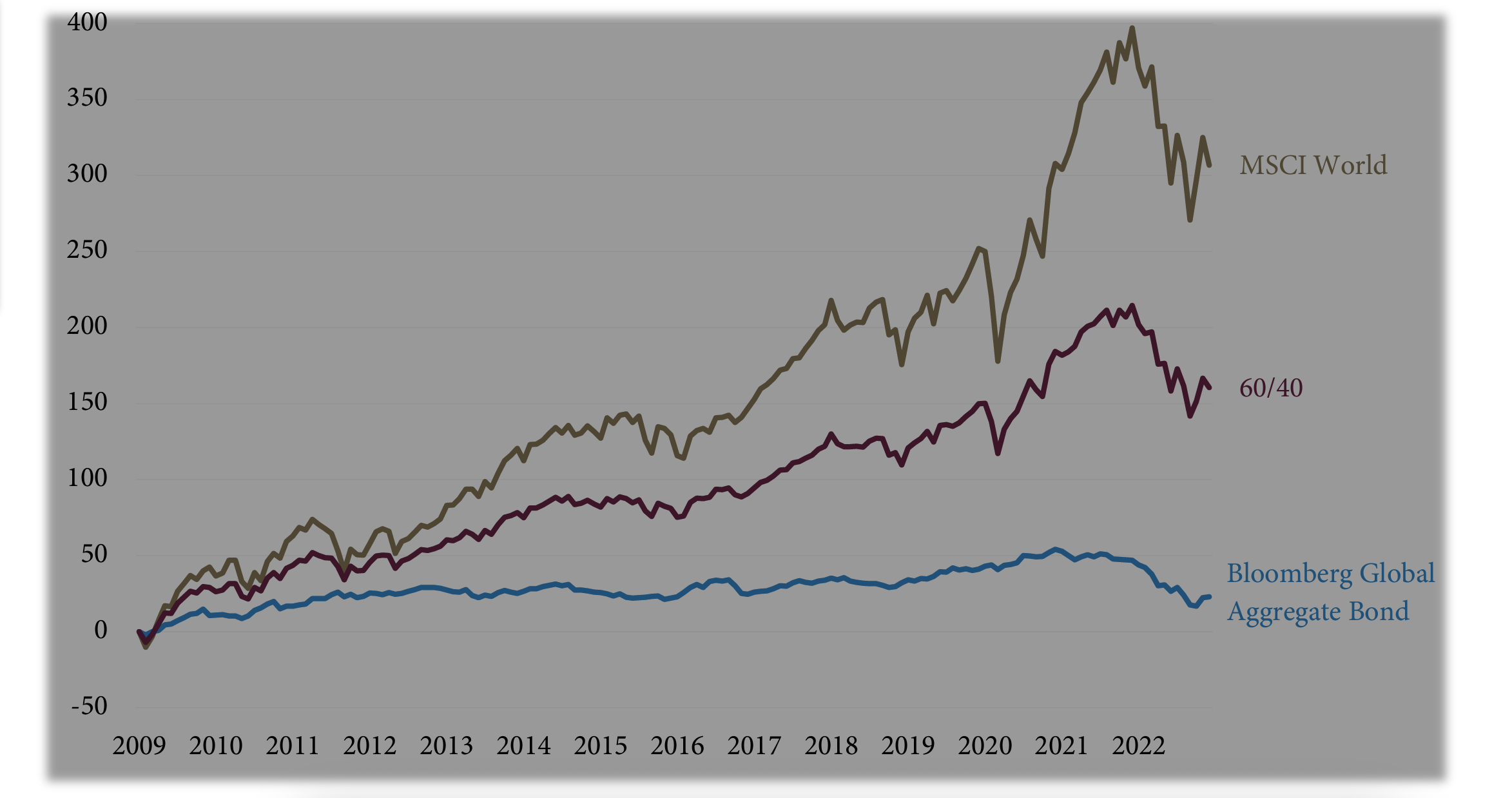

The era of extreme monetary accommodation that followed the Global Financial Crisis actually recorded more years in which bonds declined globally (five: 2013, 2015, 2018, 2021, and the historical drop in 2022) than “risky” stocks (four: 2011, 2015, 2018, and 2022). As would be expected, the environment resulted in cumulative equity returns since 2009 of 307% (MSCI World Index), significantly outpacing the cumulative bond return of 23% (Bloomberg Global Aggregate Bond Index).

No contest

(percentage change since January 2009; US dollar basis)

Source: Guardian Capital based on data from Bloomberg to December 2022

The approach of a mix of stocks and bonds was, to say the least, ineffective in 2022. Many investors were faced with the markets rewarding cash, energy, select dividend payers, and defensive alternative strategies. Sadly, the go-go decade that preceded last year resulted in a tilt away from these areas, leaving portfolios exposed to the full assault of market forces.

As much as it pains this student of economic history to say this, it is indeed true that with respect to the road ahead, this time is different. The environment going forward is distinctly different than what has prevailed since 2009. Last year marked the death of the era of ZIRP (zero interest rate policy) and abundant liquidity that has defined the previous decade-plus — and it was not a pleasant end by any means.

Monetary policy worldwide is now tuned toward the restrictive side of the dial, and interest rates are at their highest levels since 2008 (i.e., pre-ZIRP). As a result of the hard reset in bond markets, and as we noted in our communiqué last November, the risk/reward profile for fixed income has become more compelling than it has been in more than a decade (and that argument has strengthened over the last three months).

Further, with central bank tightening cycles approaching their endpoint (the Bank of Canada has already indicated that it is moving to the sidelines), the balance of risk for bonds in the months ahead is notably skewed to the upside. Over the next year, there appears to be a greater likelihood for rates to move lower than higher (which would be positive for bond prices), though the higher yields available provide a degree of protection to performance against further rate increases that have been sorely missing in recent years.

Over the past year, your portfolio has been revisited and adjustments made. The new year always presents a great time to look forward with goals and expectations in mind. With bonds now exhibiting more of their historical attributes, establishing or expanding the allocation to lower correlation strategies to the market should be top of mind. We are in a place where the relationship between return and risk is being re-introduced, and with that, the days of free money and easy gains appear to be largely over and done. We may be returning to the tried and true foundations of investing.

The opinions expressed are as of the published date and are subject to change without notice. Assumptions, opinions and estimates are provided for illustrative purposes only and are subject to significant limitations. Reliance upon this information is at the sole discretion of the reader. This document includes information and commentary concerning financial markets that was developed at a particular point in time. This information and commentary are subject to change at any time, without notice, and without update. This commentary may also include forward-looking statements concerning anticipated results, circumstances, and expectations regarding future events. Forward-looking statements require assumptions to be made and are, therefore, subject to inherent risks and uncertainties. There is significant risk that predictions and other forward-looking statements will not prove to be accurate. Investing involves risk. Equity markets are volatile and will increase and decrease in response to economic, political, regulatory and other developments. Investments in foreign securities involve certain risks that differ from the risks of investing in domestic securities. Adverse political, economic, social or other conditions in a foreign country may make the stocks of that country difficult or impossible to sell. It is more difficult to obtain reliable information about some foreign securities. The costs of investing in some foreign markets may be higher than investing in domestic markets. Investments in foreign securities also are subject to currency fluctuations. The risks and potential rewards are usually greater for small companies and companies located in emerging markets. Bond markets and fixed-income securities are sensitive to interest rate movements. Inflation, credit and default risks are also associated with fixed income securities. Diversification may not protect against market risk, and loss of principal may result. This commentary is provided for educational purposes only. It is not offered as investment advice and does not account for individual investment objectives, risk tolerance, financial situation or the timing of any transaction in any specific security or asset class. Certain information contained in this document has been obtained from external parties, which we believe to be reliable, however, we cannot guarantee its accuracy. These sources include Bloomberg, Bank of Canada and National Bank Independent Network for the relevant periods cited in this commentary. Guardian Capital Advisors LP provides private client investment services and is a subsidiary of Guardian Capital Group Limited, a publicly traded firm listed on the Toronto Stock Exchange. All trademarks, registered and unregistered, are owned by Guardian Capital Group Limited and are used under license.