Once again, a last-minute deal to raise the US debt limit and avoid a default has been reached. While this game of political “chicken” seems to occur with regular frequency, what exactly is the debt ceiling, and why does it matter?

The US debt ceiling is a statutory limit on the amount of money the US Treasury is permitted to borrow to fund existing government obligations. The limit does not explicitly influence spending legislated by Congress; rather it is a tool meant to help impose fiscal discipline.

Once that limit is hit, the government can no longer fund previously budgeted spending or other obligations, such as interest and principal payments on existing debt via the use of debt.

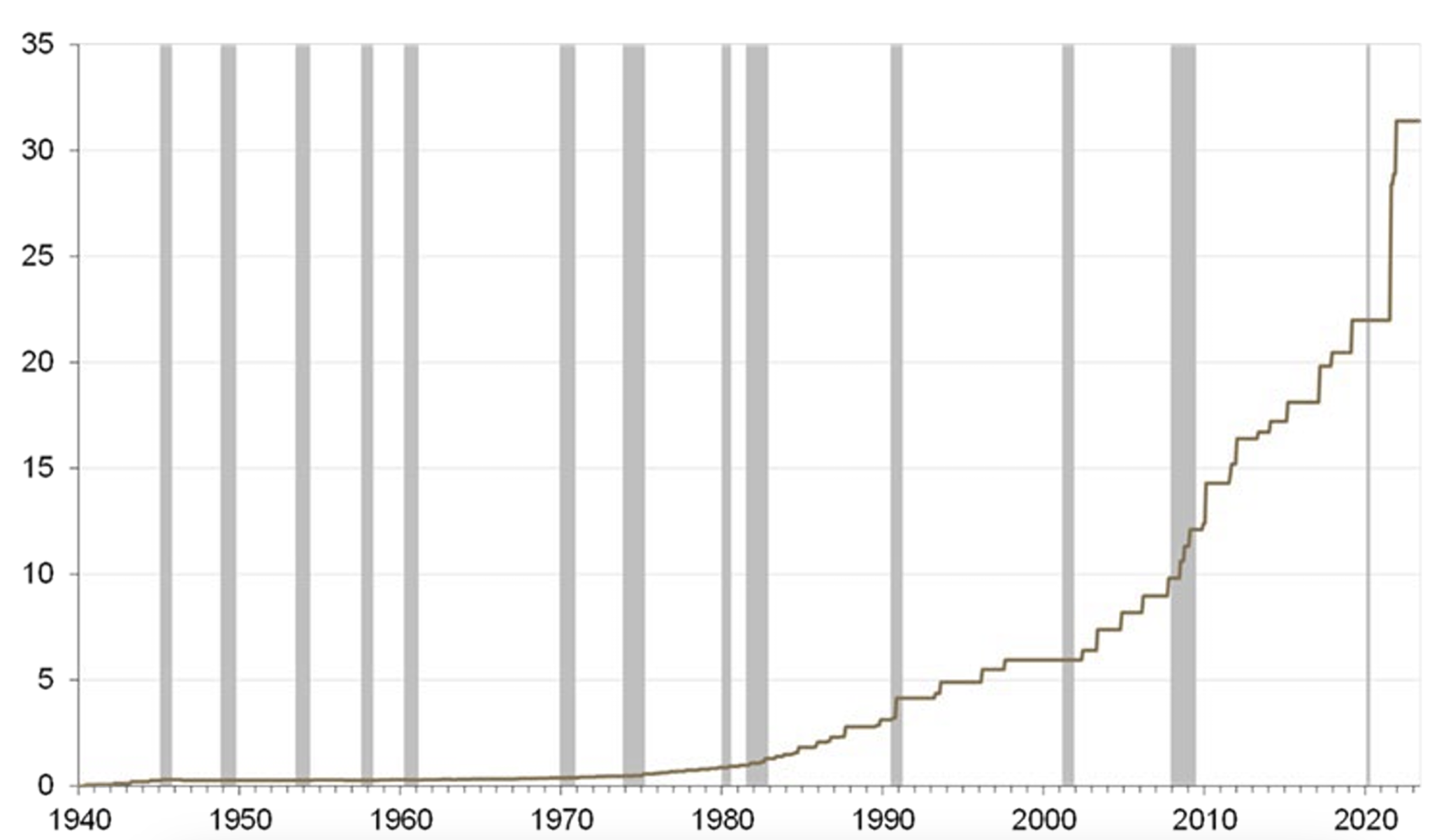

US statutory debt limit

(Trillions of US dollars)

Source: Guardian Capital based on data from the US Treasury and Bloomberg to May 11, 2023

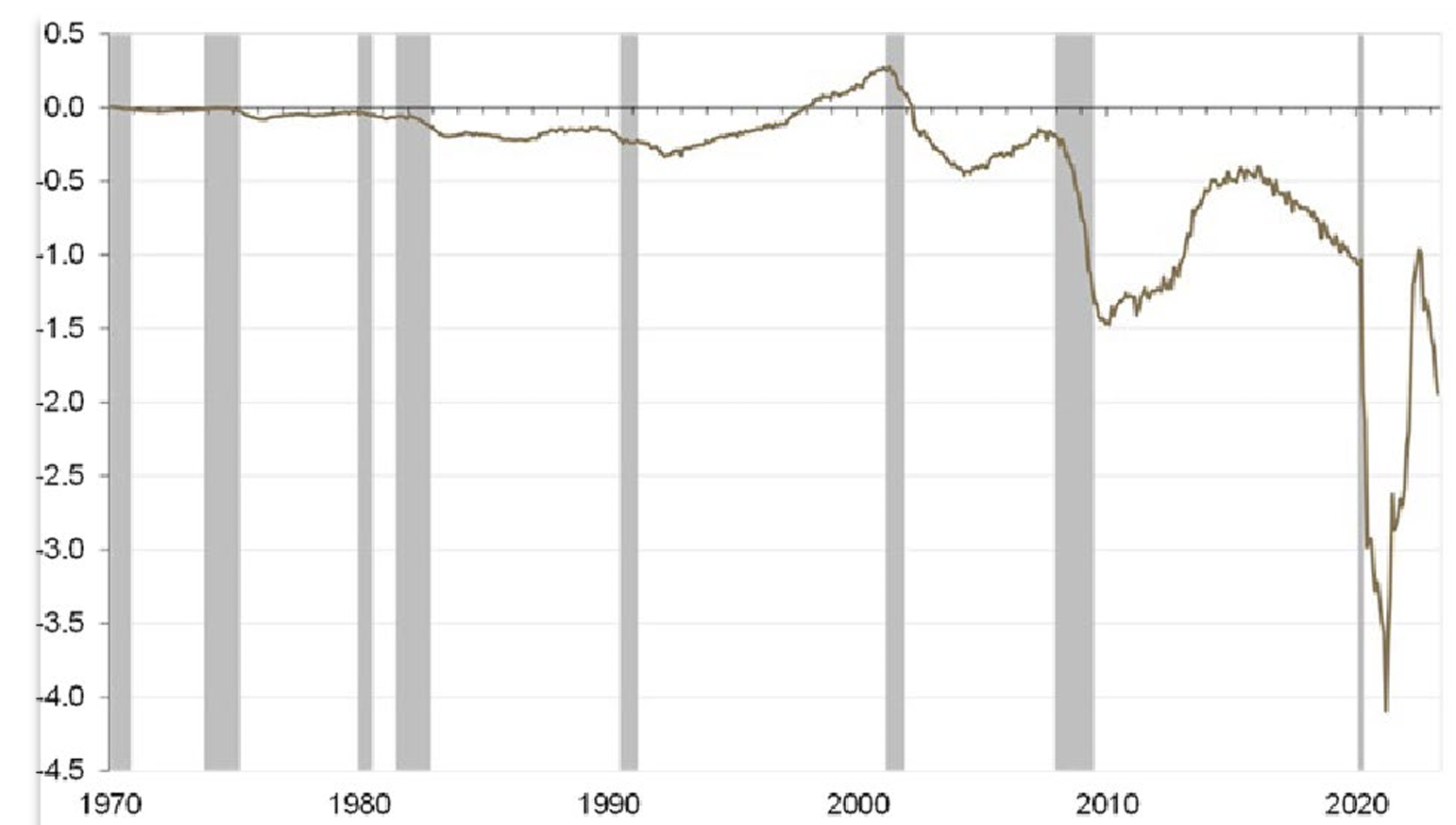

The need to raise the debt limit comes thanks to the increased tendency for the US federal government to run deficits (i.e., spending is higher than revenues). Aside from just over four years around the turn of the millennium, the US government has been in deficit for almost the entirety of the last five decades, with the magnitude of those fiscal shortfalls rising drastically in the aftermath of the Financial Crisis and further exacerbated by the pandemic.

US federal government deficit

(Trillions of US dollars; 12-month moving total)

Source: Guardian Capital based on data from the US Treasury and Bloomberg to April 2023

The failure of Congress to reach an agreement can lead to government shutdowns, such as in 1995 and 2013, and the potential for default on government debt. The former has a material impact on the domestic US economy, given that the US federal government employs 2.9 million American civilians1, while the latter has substantial implications for global financial markets. US Treasuries are not just an investment asset; they are integral in the plumbing of the global financial system. Any actual default would have significant and far-reaching implications. As a result, it is not surprising that an agreement to raise the debt limit has once again been reached at the 11th hour.

This latest episode of the debt saga underscores that while it’s important to be aware of political risks, investors should not make wholesale changes to long-term investment plans because of them.

- U.S. Bureau of Labor Statistics, All Employees, Federal [CES9091000001], FRED, Federal Reserve Bank of St. Louis, Updated May 5, 2023. https://fred.stlouisfed.org/series/CES9091000001 ↩︎

This commentary is for general informational purposes only and does not constitute investment, financial, legal, accounting, tax advice or a recommendation to buy, sell or hold a security. It shall under no circumstances be considered an offer or solicitation to deal in any product or security mentioned herein. It is only intended for the audience to whom it has been distributed and may not be reproduced or redistributed without the consent of Guardian Capital Advisors LP. This information is not intended for distribution into any jurisdiction where such distribution is restricted by law or regulation.

The opinions expressed are as of the published date and are subject to change without notice. Assumptions, opinions and estimates are provided for illustrative purposes only and are subject to significant limitations. Reliance upon this information is at the sole discretion of the reader. This document includes information and commentary concerning financial markets that was developed at a particular point in time. This information and commentary are subject to change at any time, without notice, and without update. This commentary may also include forward-looking statements concerning anticipated results, circumstances, and expectations regarding future events. Forward-looking statements require assumptions to be made and are, therefore, subject to inherent risks and uncertainties. There is significant risk that predictions and other forward-looking statements will not prove to be accurate. Investing involves risk. Equity markets are volatile and will increase and decrease in response to economic, political, regulatory and other developments. Investments in foreign securities involve certain risks that differ from the risks of investing in domestic securities. Adverse political, economic, social or other conditions in a foreign country may make the stocks of that country difficult or impossible to sell. It is more difficult to obtain reliable information about some foreign securities. The costs of investing in some foreign markets may be higher than investing in domestic markets. Investments in foreign securities also are subject to currency fluctuations. The risks and potential rewards are usually greater for small companies and companies located in emerging markets. Bond markets and fixed-income securities are sensitive to interest rate movements. Inflation, credit and default risks are also associated with fixed income securities. Diversification may not protect against market risk, and loss of principal may result. This commentary is provided for educational purposes only. It is not offered as investment advice and does not account for individual investment objectives, risk tolerance, financial situation or the timing of any transaction in any specific security or asset class. Certain information contained in this document has been obtained from external parties, which we believe to be reliable, however, we cannot guarantee its accuracy. These sources include Bloomberg, Bank of Canada and National Bank Independent Network for the relevant periods cited in this commentary. Guardian Capital Advisors LP provides private client investment services and is an indirect wholly owned subsidiary of Guardian Capital Group Limited, a publicly traded firm listed on the Toronto Stock Exchange. All trademarks, registered and unregistered, are owned by Guardian Capital Group Limited and are used under license.