There is an old investing adage that states bull markets climb a wall of worry. That is to say, stock markets tend to sustainably thrive when there is a healthy dose of skepticism among investors, with abundant focus on the numerous potential downside risks that could knock a rally off track.

In these environments, enthusiasm is kept in check and expectations tempered, preventing valuations from becoming untethered from fundamentals. Upward market momentum is then able to be maintained as “worst case” scenarios do not come to fruition and the economy trudges forward.

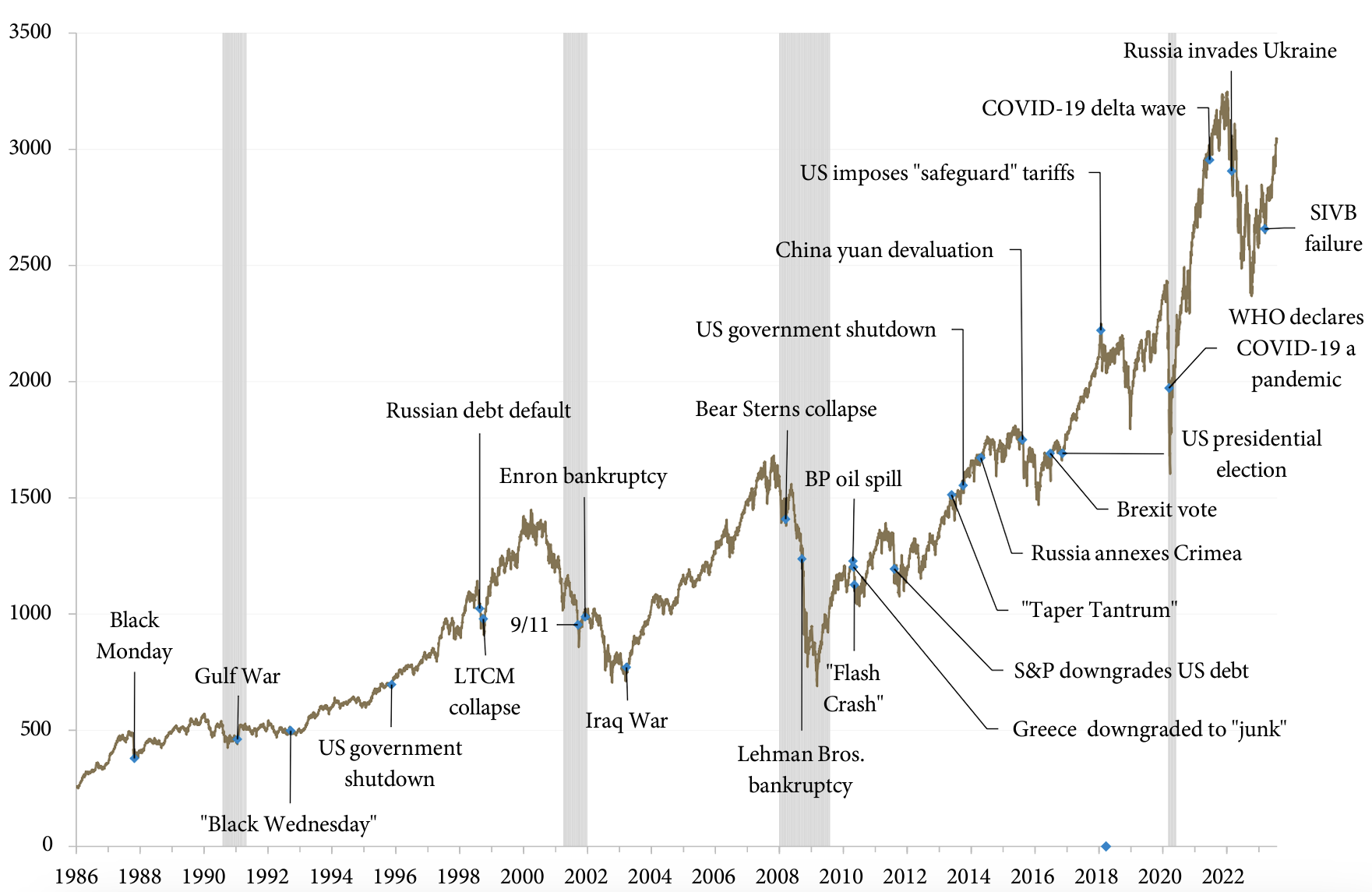

Financial market history is filled with the “next big crises” — these are the bricks that make up the wall of worry. While these events may cause disruptions and volatility, they more often than not prove temporary, and the outcome is rarely as bad as feared. Markets ultimately resume their climb.

Climbing the wall of worry

(MSCI World Index; index, December 31, 1969=100)

Shaded regions represent periods of US recession; source: Guardian Capital based on data from Bloomberg to July 25, 2023

To borrow from a pop icon who is currently doing her part to stimulate the economy with her massive global tour, a castle could be built with all the bricks being thrown at the moment.

These persistent concerns for the outlook — including but not limited to the impact of interest rates, high inflation, and simmering geopolitical tensions — are restraining sentiment and helping to prevent the build-up of excesses in the financial system that can lead to wide-spread shocks.

At the same time, the foundations that have underpinned growth since the onset of the pandemic largely remain intact while the headwind of higher cost pressures is ebbing — that stands to ease pressure on policymakers to take interest rates higher — setting up the potential for the global economy to continue to surprise those still waiting intently for things to turn for the worse.

Of course, it is unlikely the path forward will be free and clear, with new developments seemingly coming from nowhere and adding bricks to the pile — and creating even more entries on the ever-present list of reasons investors have to sell.

It is, therefore, once again worthwhile to emphasize that it is “time in,” not “timing” the market that is the key to building wealth in the long-run — markets may lose their footing temporarily, but history shows they do find their traction again and continue to scale the wall of worry, leaving those that opted to jump off with a lot of work to get back up.

This commentary is for general informational purposes only and does not constitute investment, financial, legal, accounting, tax advice or a recommendation to buy, sell or hold a security. It shall under no circumstances be considered an offer or solicitation to deal in any product or security mentioned herein. It is only intended for the audience to whom it has been distributed and may not be reproduced or redistributed without the consent of Guardian Capital Advisors LP. This information is not intended for distribution into any jurisdiction where such distribution is restricted by law or regulation.

The opinions expressed are as of the published date and are subject to change without notice. Assumptions, opinions and estimates are provided for illustrative purposes only and are subject to significant limitations. Reliance upon this information is at the sole discretion of the reader. This document includes information and commentary concerning financial markets that was developed at a particular point in time. This information and commentary are subject to change at any time, without notice, and without update. This commentary may also include forward-looking statements concerning anticipated results, circumstances, and expectations regarding future events. Forward-looking statements require assumptions to be made and are, therefore, subject to inherent risks and uncertainties. There is significant risk that predictions and other forward-looking statements will not prove to be accurate. Investing involves risk. Equity markets are volatile and will increase and decrease in response to economic, political, regulatory and other developments. Investments in foreign securities involve certain risks that differ from the risks of investing in domestic securities. Adverse political, economic, social or other conditions in a foreign country may make the stocks of that country difficult or impossible to sell. It is more difficult to obtain reliable information about some foreign securities. The costs of investing in some foreign markets may be higher than investing in domestic markets. Investments in foreign securities also are subject to currency fluctuations. The risks and potential rewards are usually greater for small companies and companies located in emerging markets. Bond markets and fixed-income securities are sensitive to interest rate movements. Inflation, credit and default risks are also associated with fixed income securities. Diversification may not protect against market risk, and loss of principal may result. This commentary is provided for educational purposes only. It is not offered as investment advice and does not account for individual investment objectives, risk tolerance, financial situation or the timing of any transaction in any specific security or asset class. Certain information contained in this document has been obtained from external parties, which we believe to be reliable, however, we cannot guarantee its accuracy. These sources include Bloomberg, Bank of Canada and National Bank Independent Network for the relevant periods cited in this commentary. Guardian Capital Advisors LP provides private client investment services and is an indirect wholly owned subsidiary of Guardian Capital Group Limited, a publicly traded firm listed on the Toronto Stock Exchange. All trademarks, registered and unregistered, are owned by Guardian Capital Group Limited and are used under license.