All returns are stated in Canadian dollar terms.

Equities

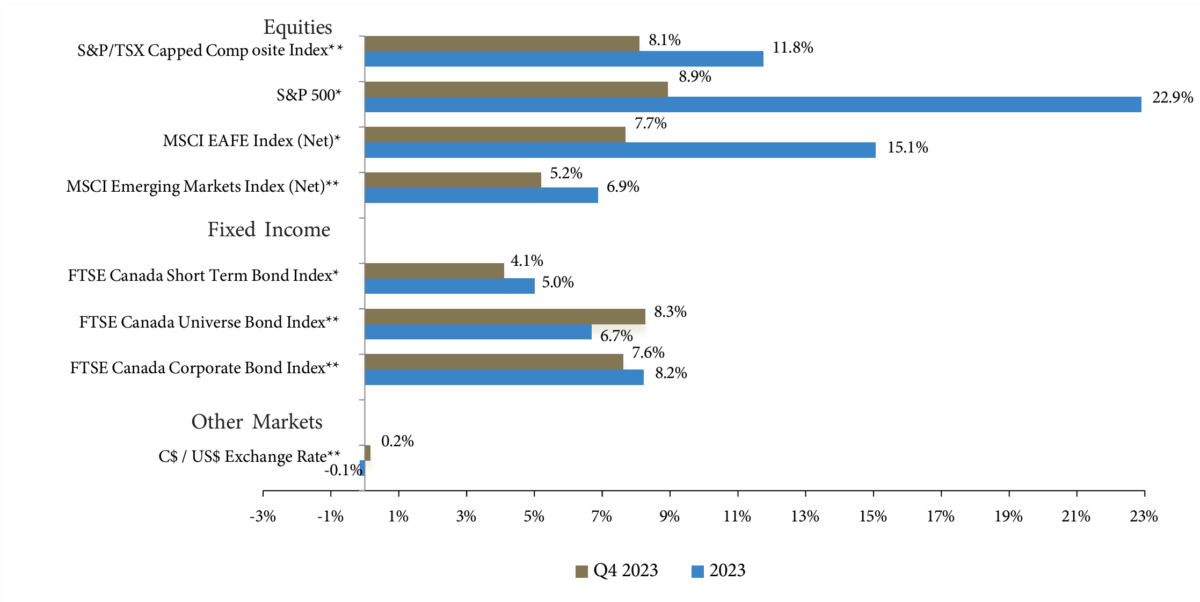

Developed Market (DM) equities rallied over the final three months of 2023 to conclude a year of gains as investors welcomed signs that interest rates may finally be plateauing. Over the quarter, the MSCI EAFE Index rose 7.7% and the S&P 500 index rose 8.9%, with the Information Technology sector in both benchmarks continuing its remarkable strength over the course of the year.

Closer to home, the TSX Composite index rose 8.1%, also propelled by an Information Technology sector that rose 24.0% in the quarter to bring full year gains to 36.0% for this cohort. In contrast to fairly narrow strength for most of the year, gains were widespread this quarter, with 10 of 11 sectors rising across the TSX and the S&P 500 benchmark, and all 11 sectors increasing across the MSCI EAFE index. Energy was the weakest group in all markets, tracking a 21.0% decline in the price of West Texas Intermediate (WTI) crude oil over the quarter as global demand, particularly out of China, seems to be ebbing.

The upward thrust of the fourth quarter built upon prior gains to make for an excellent year in all DM equity markets, with the MSCI EAFE index rising 15.1% and the S&P 500 index rising 22.9%, while the TSX Composite index gained 11.8%.

The highest profile group over 2023 was the “Magnificent 7”, a handful of major technology-oriented stocks that were a near singular point of strength in the US markets for most of 2023, with Apple on the low end with 44.6% gains and Nvidia on the high end with 230.8% gains over the year. The strength in this group was such that the technology-heavy Nasdaq Composite index rose 40.0% in 2023, among the best years for this index since the heights of the dotcom boom in 1999.

After this robust year, equity market performance will likely be contingent upon further moderation in inflation, a prerequisite for tempering interest rates and alleviating pressure on both commercial and residential housing markets in Europe and North America. This will be joined by the Chinese economy, long a source of strength but lately showing signs of slowing demand for real estate and discretionary goods, as factors influencing equity market performance in 2024.

Fixed Income

Global bond markets underwent a substantial shift in the closing months of 2023. The concerns that dominated the summer and early fall — that persistent economic resiliency in the face of numerous headwinds posed upside risks to inflation and would lead central bank hiking cycles to higher than previously assumed terminal points that would be maintained for a long time — saw an abrupt reversal as gauges of underlying price pressures continued to moderate amid further indications of the desired rebalancing of supply and demand.

The resultant moves lower from decade-plus highs in market interest rates that began early November were then accelerated by a notably softer tone from global central banks that was punctuated in December when the US Federal Reserve(Fed) indicated a lower projected path for policy rates and indicated that discussions had begun on when it would be appropriate to start cutting policy interest rates.

The ensuing plunge in yields across the yield curve drove the best two-month performance in the domestic benchmark FTSE Canada Universe Index since 1982, closing out the best quarter for the aggregated bond gauge since 1985 — more rate sensitive longer-duration and government securities outperformed their shorter-term and corporate counterparts in the quarter — and ensuring that 2023 did not see the ignominy of a record-setting third consecutive annual loss for fixed income investors and instead ended up +7.0 % for the calendar year as a whole.

Looking forward, the prospects for bond markets appear positive. While it seems that the peak in rates for this cycle has likely passed, yields remain at levels that provide among the best risk/reward tradeoffs for bonds in more than a decade. Further, the expectations of a continued moderation of inflation would appear to suggest that lower will be the ultimate path of least resistance for market rates, which combined with modest, but still positive, economic growth would support earnings and credit quality. All speak in favour of a potentially good year ahead for bondholders.

That said, the magnitude of the moves at the end of last year as markets aggressively repriced both the timing and magnitude of rate cuts (Fed funds futures, for example, have brought forward the expected first rate cut to March and are now pricing twice as many rate cuts by 2024’s year-end than the Fed’s December “dot plot” indicated) suggests that there may be some near-term vulnerability to a reversal of Q4’s outsized gains to kickoff the New Year, particularly if there are signs that central banks may not prove as proactive in moving policy back toward “neutral” settings.

Market Indices Performance

Source: Bloomberg; All figures stated in Canadian dollars

* As of December 29, 2023

** As of December 31, 2023

Commentary

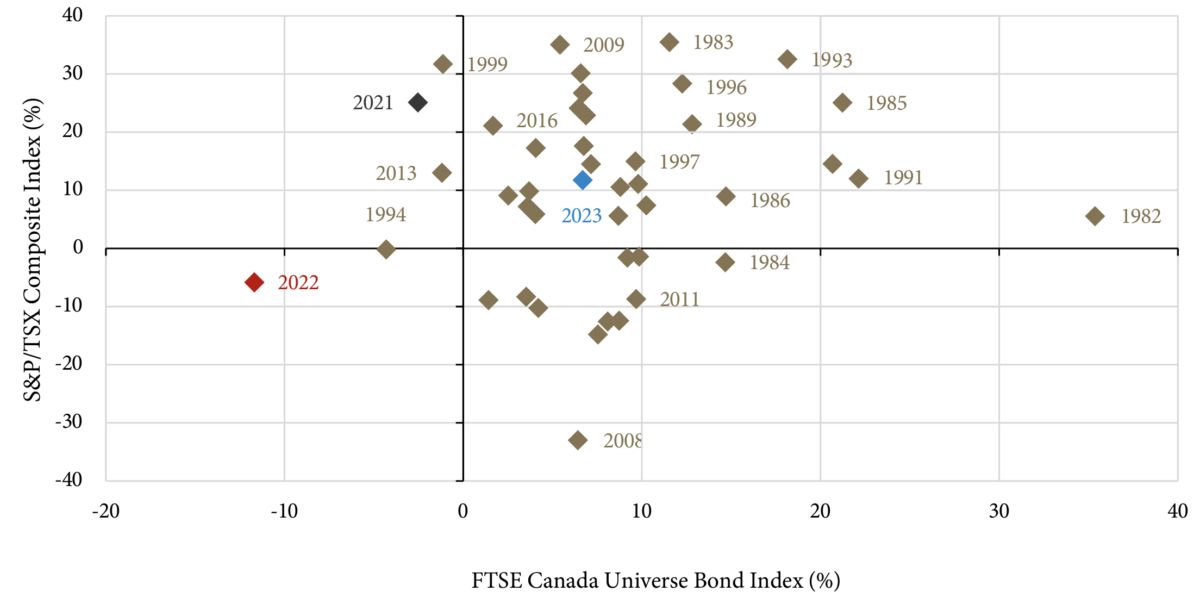

With it all now said and done, the financial market performance of the last year will hardly garner much attention in future economist and data analysts’ superficial review. After all, the S&P/TSX Composite Index’s near 12% total return is bang on the average (and median) gain since 1980, as is the close to 7% gain in Canada’s domestic bond market benchmark (the FTSE Canada Universe Bond Index) over the same period. A marked return to “normal” following the historical outlier that was 2022.

Calendar year total returns

(percent, Canadian dollar basis)

Source: Guardian Capital based on monthly data from Bloomberg and PC Bond from December 1979 to December 2023

Of course, the past 12 months have been anything but “run of the mill” for markets. In fact, as recently as the end of October, Canadian equities were tracking for a flat year — and though global stocks were outperforming, it was due to historically narrow market leadership that offset similarly flat performance elsewhere — while bonds were on pace for a record-breaking third consecutive year of declines. All it took to get to “normal” was two abnormally strong months across markets — Canadian stocks posted their best two-month stretch in three years while the aggregated bond market turned in its best two months since 1982.

This is yet another case of how assuming something is a foregone conclusion can be a risky proposition for investors — as New York Yankee great Yogi Berra said, “It ain’t over ‘til it’s over”.

The New Year has far to go before it is over and will undoubtedly again be filled with surprises for investors, with new developments and unexpected events causing a rethink of best-laid plans for the road ahead. At the same time, it is arguable that there is at least more clarity over what is to come than there has been in recent years — the backdrop remains highly uncertain, but less so than at any point since the pandemic began.

The factors that have underpinned the surprising resiliency of the economy over the last three years broadly remain in place — consumers remain in relatively good shape for this stage of the cycle with elevated savings and strong balance sheets complemented by firm job markets worldwide. Perhaps more importantly, though, the major macroeconomic risks that dampened expectations are subsiding, notwithstanding that geopolitical tensions remain on a simmer and wars are being fought on several fronts at the moment that could well expand and intensify.

Inflationary pressures have moderated back within the realm of “normal” as the supply-side rifts of the pandemic fade and the impact of the aggressive and globally synchronized monetary policy tightening temper demand, and this trend is anticipated to continue. In turn, the broad progress in restoring price stability has eased pressure on central bankers to tighten the screws further — and while one can never say never, recent rhetoric suggests that the peak in rates has passed as policymaker attention turns toward moving from “restrictive” back to “neutral” as they attempt to navigate a “soft landing.”

Against this, market expectations that were almost uniformly looking for a material downturn at this point last year have come around to a more sanguine outlook of low but positive growth, moderate inflation and lower interest rates — which supported the broadening risk rally seen over the last nine weeks of 2023 that would arguably appear to have further room to run as the rest of the market plays catch-up to the handful of leaders following two depressed years.

Obviously, this is a positive for investors, but nothing is certain and plenty of risks remain. For example, there is reason for caution in assuming central banks are fully done with their hiking cycles until they actually start to cut — and until that point, it is likely that markets will be prone to knee-jerk reactions to the dataflow and officials’ comments.

As such, though the outlook for the months ahead appears conducive to positive risk asset returns and could allow investors to breathe a collective sigh of relief following three highly volatile years, it is important to maintain a focus on managing risk exposures — and the decades-best opportunities present in the bond market for safe, income-generating assets provide a plus in this column — to ensure long-term financial health. After all, to use another “Yogi-ism,” “If the world were perfect, it wouldn’t be.”

The opinions expressed are as of the published date and are subject to change without notice. Assumptions, opinions and estimates are provided for illustrative purposes only and are subject to significant limitations. Reliance upon this information is at the sole discretion of the reader. This document includes information and commentary concerning financial markets that was developed at a particular point in time. This information and commentary are subject to change at any time, without notice, and without update. This commentary may also include forward-looking statements concerning anticipated results, circumstances, and expectations regarding future events. Forward-looking statements require assumptions to be made and are, therefore, subject to inherent risks and uncertainties. There is significant risk that predictions and other forward-looking statements will not prove to be accurate. Investing involves risk. Equity markets are volatile and will increase and decrease in response to economic, political, regulatory and other developments. Investments in foreign securities involve certain risks that differ from the risks of investing in domestic securities. Adverse political, economic, social or other conditions in a foreign country may make the stocks of that country difficult or impossible to sell. It is more difficult to obtain reliable information about some foreign securities. The costs of investing in some foreign markets may be higher than investing in domestic markets. Investments in foreign securities also are subject to currency fluctuations. The risks and potential rewards are usually greater for small companies and companies located in emerging markets. Bond markets and fixed-income securities are sensitive to interest rate movements. Inflation, credit and default risks are also associated with fixed income securities. Diversification may not protect against market risk, and loss of principal may result. This commentary is provided for educational purposes only. It is not offered as investment advice and does not account for individual investment objectives, risk tolerance, financial situation or the timing of any transaction in any specific security or asset class. Certain information contained in this document has been obtained from external parties, which we believe to be reliable, however, we cannot guarantee its accuracy. These sources include Bloomberg, Bank of Canada and National Bank Independent Network for the relevant periods cited in this commentary. Guardian Capital Advisors LP provides private client investment services and is an indirect wholly owned subsidiary of Guardian Capital Group Limited, a publicly traded firm listed on the Toronto Stock Exchange. All trademarks, registered and unregistered, are owned by Guardian Capital Group Limited and are used under license.