Equity Commentary

Developed Markets (DM) retraced moderately in the third quarter, reversing a portion of the gains generated over the prior nine months. Weakness was equally felt across regions, with the international MSCI EAFE Index falling 4.1% and the S&P 500 benchmark falling 3.3% in the United States, both in US dollar terms, although the weakness in the Canadian dollar buffered these losses for Canadian investors (-2.0% and -1.3%, respectively).

Closer to home, the S&P/TSX Composite Index fell 2.2% in Canadian dollar terms, with strength in the Energy sector making it the only group of significance to rise in value this quarter (the much smaller Health Care sector also managed to produce gains). Energy was also the main bright spot outside of Canada, being the only sector to rise in the EAFE markets and one of only two sectors in the US markets to gain value (alongside Communication Services), in all cases spurred by strength in crude oil prices. Weakness pervaded all other sectors of the markets as higher interest rates continues to have a broad impact across many industries, the conflict between Russia and Ukraine continues, and political relations between the United States and China continue to deteriorate.

An important sentiment influencing stock prices over the quarter was worry about the state of the economy in China as evidence surfaces that construction markets continue to cool and negatively impact the financial health of local citizens. Companies with an exposure to Chinese consumer demand for their goods or services saw considerable share price pressure, a group that includes a wide range of Consumer Discretionary, Industrial, Information Technology, Health Care and Consumer Staples providers. With valuations now reflecting a much-diminished optimism for many of these companies, the evolution of the Chinese economy is set to be a key focal point for equity investors in coming quarters.

Fixed Income Commentary

Continued signs of economic resiliency across developed markets raised concerns among central bankers over the potential upside risks to inflation. They spurred further broad-based policy tightening in Q3 (including hikes from the Bank of Canada, US Federal Reserve, Bank of England and European Central Bank). However, this also increased expectations that rates could move higher still and remain elevated for longer than previously assumed.

In response, market interest rates rose materially in Q3 — the yield curve, while still deeply inverted, actually steepened notably as longer-term rates rose more than those on shorter-duration bonds — and finished the quarter at their highest levels in more than a decade-and-a-half and drove another quarter of negative performance for the bond market.

The benchmark FTSE Canada Universe Bond Index fell 3.9% in the three months ended September, its second consecutive quarterly decline and largest since Q2 2022, and now is on pace to record its unprecedented third straight annual drop (-1.5% year-to-date). All sub-groupings were down in Q3, though the more rate-sensitive areas of the market such as government (FTSE Canada All Government Bond Index -4.4%) and long maturity bonds (FTSE Canada Long Term Bond Index -9.5%) fared worse than lower duration corporate (FTSE Canada All Corporate Bond Index -2.2%) and short-term (FTSE Canada Short Term Bond Index -0.1%).

The skewing of near-term risks for policy rates to the upside could serve as a headwind for fixed income assets in the coming months. However, the painful re-rating in the market and the likelihood that tightening cycles are nearing their endpoints suggest that better days lie ahead. The higher yields on offer have greatly improved the risk/reward profile on bonds and created the most constructive outlook for investors in decades.

Commentary

While there are always stories of people winning big at the casino, the fact of the matter is that surrounding the games of chance with flashing lights and loud sounds is by design so that bettors will leave the building with less money than with which they came — and thanks to the “house edge” (odds advantage in favour of the casino), there is a bigger probability gamblers lose more money the longer they stay at the tables. There, arguably, is value in the experience of playing and being in an exciting environment, but ultimately, the house always wins that zero-sum game.

Compare and contrast with financial markets, where history shows that the odds favour investors — and the longer the exposure, the higher the odds of turning a profit.

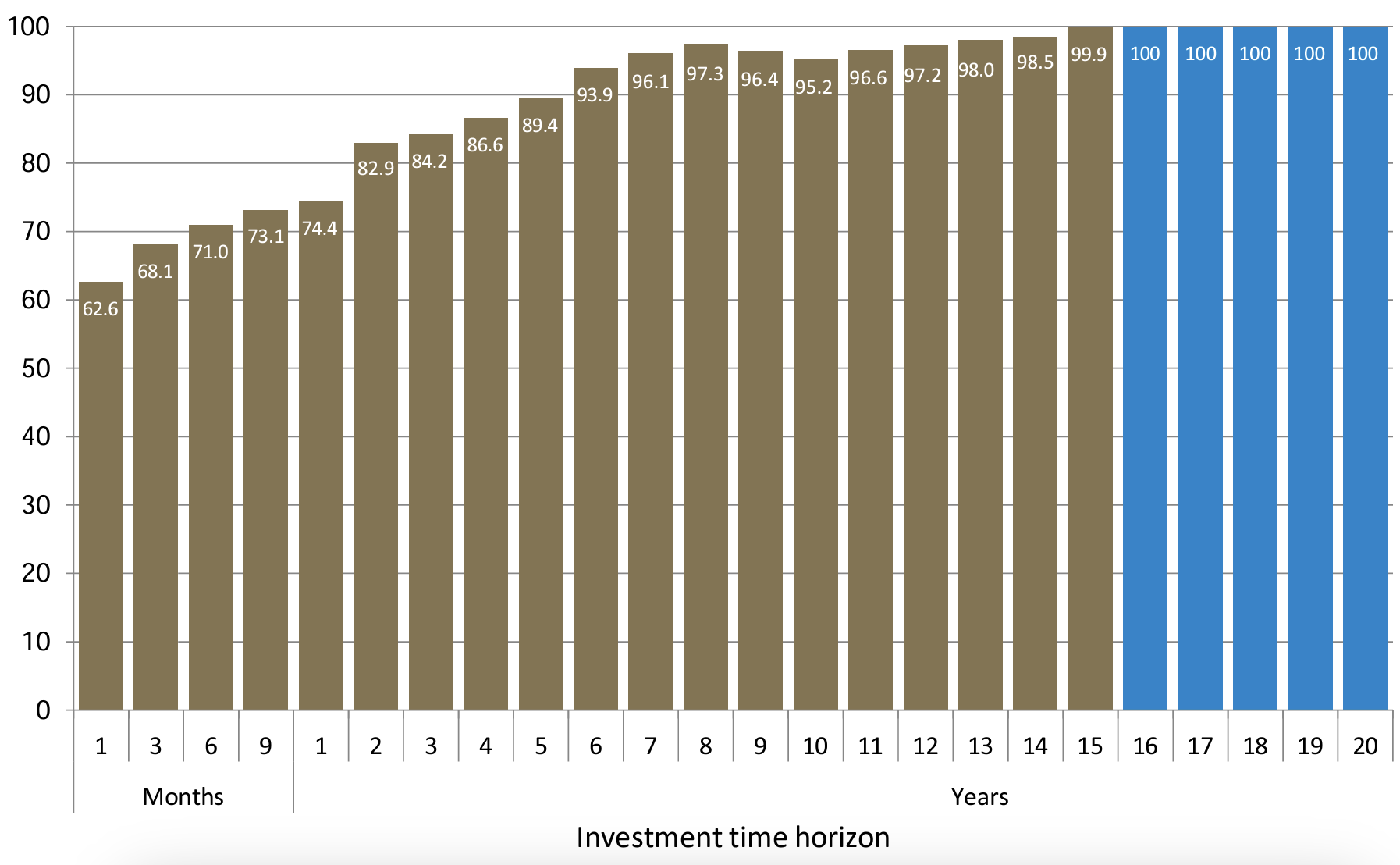

Despite the recent feeling that markets tend to go down more often than not, historically, the odds of the S&P 500 generating positive returns over any given month are roughly 2-to-1 (62.6%), while over a 12-month time frame, those odds rise to 3-to-1 (74.4%) and over six years, the probability moves up above 90%. Further, there has been no 16-year time frame over the last 95 years (since 1928) that the broad US equity market has turned in negative performance (and there is just a single instance of negative returns over a 15-year horizon, the period ending August 1944).

Percent of time S&P 500 total returns were positive over different investment horizons

(percent)

Source: Guardian Capital based on monthly data from Bloomberg and Robert Shiller from December 1927 to September 2023.

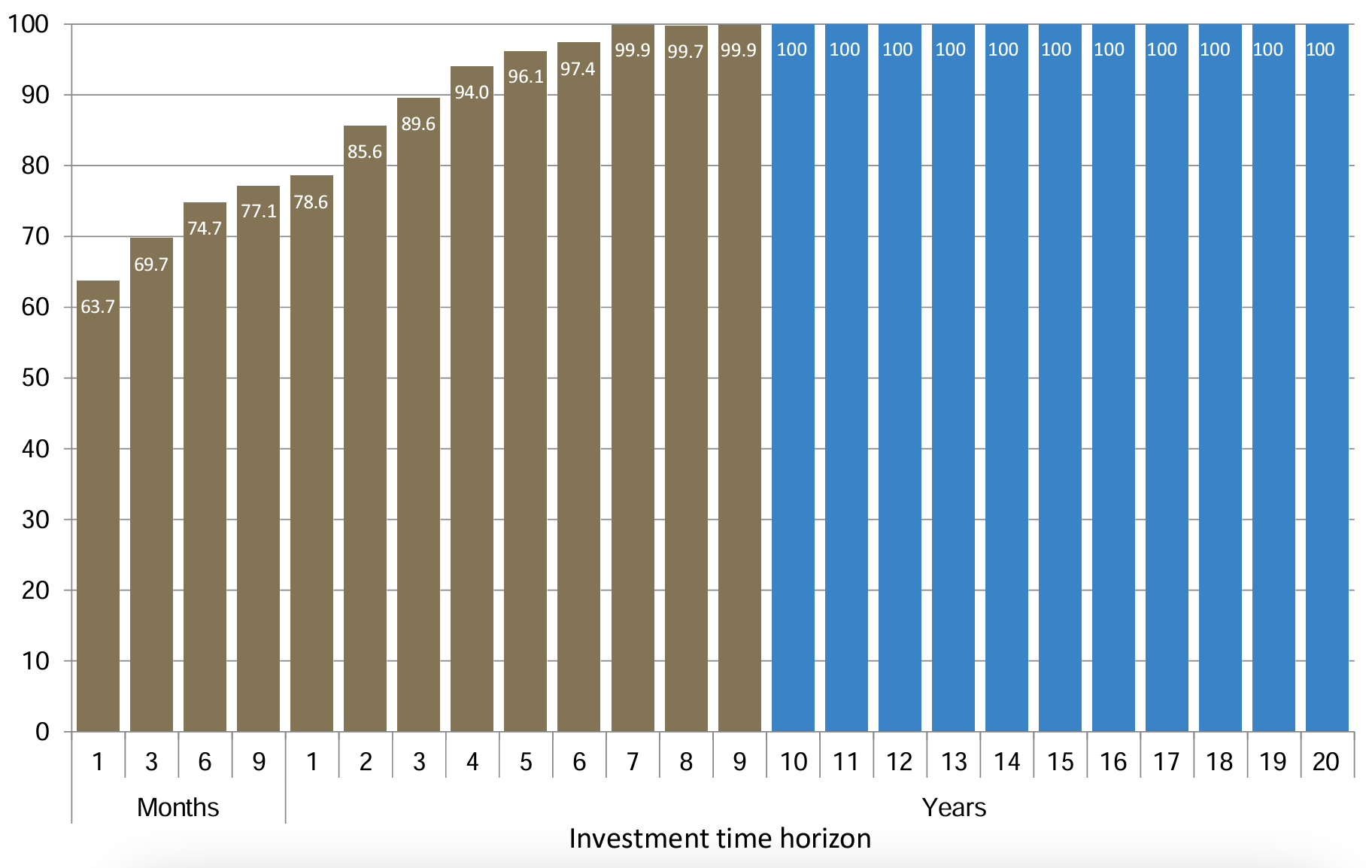

The odds can be made even more favourable by diversifying portfolio holdings with assets that do not move in lockstep with stocks. For example, a portfolio of 60% stocks and 40% bonds has only seen negative returns over a seven-year time horizon once (period ended March 1935) and has never been in the red over any 10-year span in 95 years.

Percent of time 60/40* portfolio returns were positive over different investment horizons

(percent)

*60/40 portfolio is 60% S&P 500, 40% 10-year US Treasury Notes; source: Guardian Capital based on monthly data from Bloomberg and Robert Shiller from December 1927 to September 2023

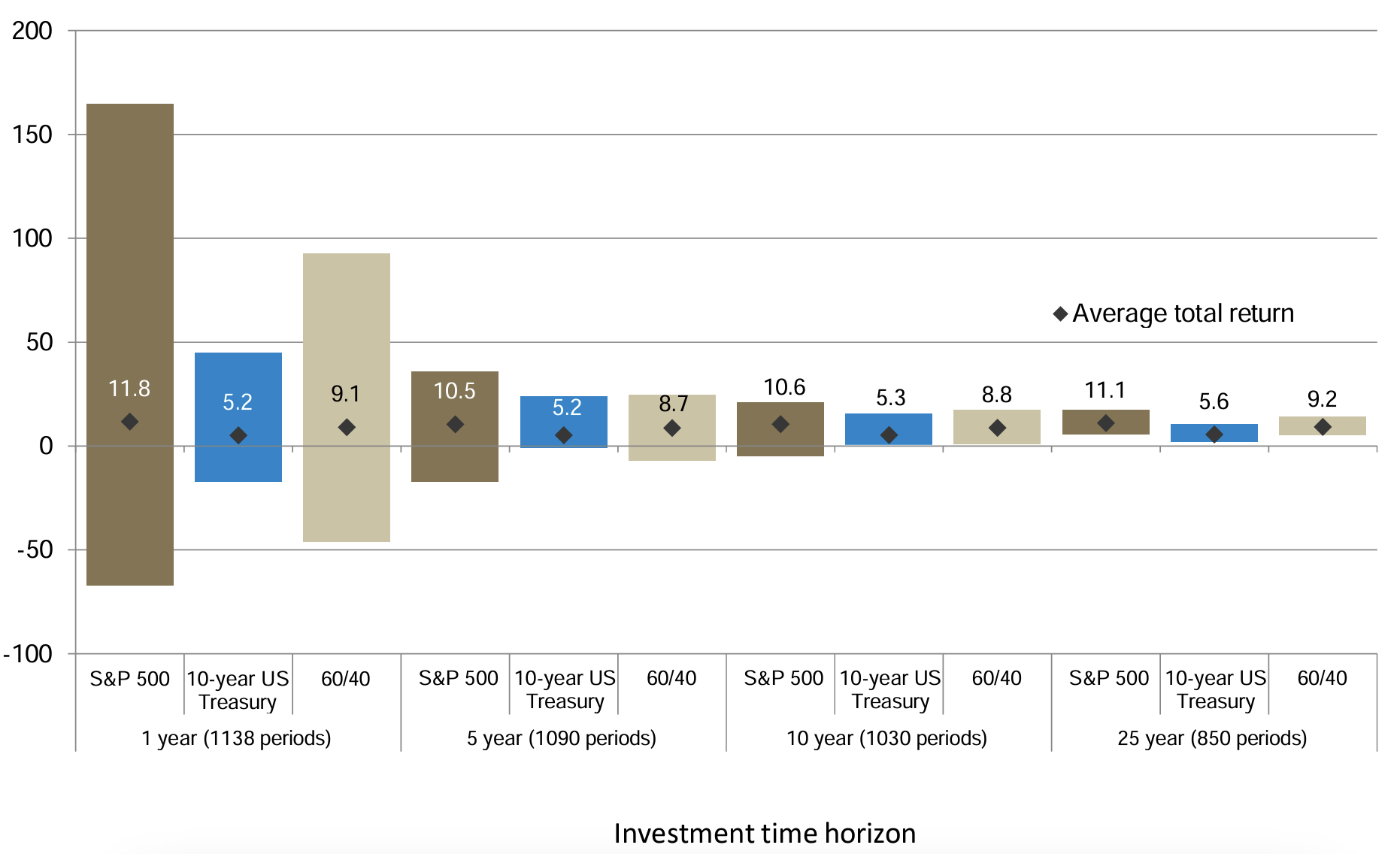

In other words, a diversified portfolio and long-term focus give you the best chance to end up in the black in the future — giving you more financial freedom to enjoy the glitz and glam of the casino floor if you so choose.

Range of total returns over different investment horizon

(annualized percent)

Source: Guardian Capital based on monthly data from Bloomberg and Robert Shiller from December 1927 to September 2023

The opinions expressed are as of the published date and are subject to change without notice. Assumptions, opinions and estimates are provided for illustrative purposes only and are subject to significant limitations. Reliance upon this information is at the sole discretion of the reader. This document includes information and commentary concerning financial markets that was developed at a particular point in time. This information and commentary are subject to change at any time, without notice, and without update. This commentary may also include forward-looking statements concerning anticipated results, circumstances, and expectations regarding future events. Forward-looking statements require assumptions to be made and are, therefore, subject to inherent risks and uncertainties. There is significant risk that predictions and other forward-looking statements will not prove to be accurate. Investing involves risk. Equity markets are volatile and will increase and decrease in response to economic, political, regulatory and other developments. Investments in foreign securities involve certain risks that differ from the risks of investing in domestic securities. Adverse political, economic, social or other conditions in a foreign country may make the stocks of that country difficult or impossible to sell. It is more difficult to obtain reliable information about some foreign securities. The costs of investing in some foreign markets may be higher than investing in domestic markets. Investments in foreign securities also are subject to currency fluctuations. The risks and potential rewards are usually greater for small companies and companies located in emerging markets. Bond markets and fixed-income securities are sensitive to interest rate movements. Inflation, credit and default risks are also associated with fixed income securities. Diversification may not protect against market risk, and loss of principal may result. This commentary is provided for educational purposes only. It is not offered as investment advice and does not account for individual investment objectives, risk tolerance, financial situation or the timing of any transaction in any specific security or asset class. Certain information contained in this document has been obtained from external parties, which we believe to be reliable, however, we cannot guarantee its accuracy. These sources include Bloomberg, Bank of Canada and National Bank Independent Network for the relevant periods cited in this commentary. Guardian Capital Advisors LP provides private client investment services and is an indirect wholly owned subsidiary of Guardian Capital Group Limited, a publicly traded firm listed on the Toronto Stock Exchange. All trademarks, registered and unregistered, are owned by Guardian Capital Group Limited and are used under license.