All returns are stated in Canadian dollar terms unless indicated otherwise.

Equities

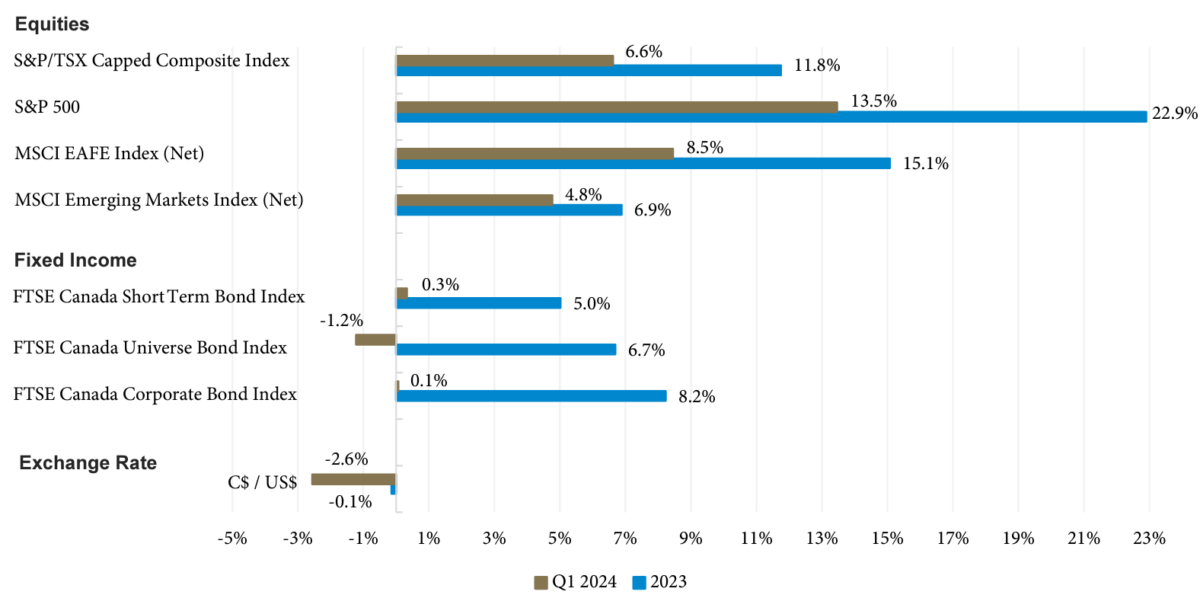

Developed Market (DM) equities built on the gains of last year with a strong first quarter in 2024 that continued to be led, as was the case over 2023, by a cohort of high-growth stocks. Over the quarter, the S&P 500 index rose 10.6% and the MSCI EAFE index rose 5.8%, both in US dollar terms, with a weaker Canadian dollar parlaying these into gains of 13.5% and 8.5% for Canadian investors.

In the US, gains were made in every sector aside from Real Estate, with the standout groups being Information Technology and Communication Services. The MSCI EAFE benchmark was also led by the Information Technology sector, although geographically was supported by Japan. A renewed wave of corporate reform, along with the Bank of Japan relaxing a longstanding policy to tether interest rates near 0%, combined to make Japanese equities among the very best globally in early 2024, with the MSCI Japan Total Return Index (net) rising 13.9%. Closer to home, the S&P/TSX Capped Composite Index also participated in this rally, rising 6.6% as nine of 11 sectors saw price gains.

A notable holdout to this global rally in equity markets was Hong Kong, where the Hang Seng Index fell 0.7% over the quarter as investors await signs of improvement in the Chinese economy. This brings the Canadian dollar return from the Hang Seng Index over the past decade to a cumulative loss of 9.2%, a notable laggard when compared to a 292.1% cumulative gain in the S&P 500 Index over the same span.

Equity market gains over the past six quarters have brought major indices either to levels approaching previous peaks, as is the case in Canada, or to new all-time highs, most notably in the US. The market strength thus far, however, has been attributable to a relatively narrow set of stocks associated with artificial intelligence technology. NVIDIA, the large US semiconductor developer, more than tripled in 2023 and proceeded to rise a further 87% during the first quarter of 2024.

Although there have been lesser points of strength in other sectors, a broader upswing across other industries would provide increased comfort that recent gains can be sustained. A likely influence in coming quarters will be central bank policy, given considerable investor debate over the timing and pace of cuts to short-term interest rates, which in turn will influence the state of commercial and residential real estate markets, and consumer balance sheets more broadly.

Fixed Income

Bond markets faced a reality check to start 2024 following their historic end to 2023. The continued resiliency in the economic dataflow into the New Year — particularly firmer than anticipated readings on gauges of underlying inflationary pressures, and an indication that central banks may not be as proactive as hoped in moving toward a more “neutral” policy setting — caused a rethink of the expectations of imminent and aggressive rate cuts that had fueled the year-end rally.

The net result was a broad move higher in market interest rates across the curve that weighed on fixed income performance over the three months that ended March. The domestic benchmark FTSE Canada Universe Index declined 1.2% in Q1 while the more rate-sensitive segments of the market, such as longer duration (FTSE Canada Long Term Overall Index -3.6%) and government bonds (FTSE Canada All Government Bond Index -1.7%), underperformed other areas such as shorter- term (FTSE Canada Short Term Overall Index +0.3%) and corporate (FTSE Canada All Corporate Bond Index +0.1%).

The moves in the first quarter only amounted to a partial retracement of the outsized ones recorded late last year. Instead of a complete change in the direction of policy such as the one that triggered the selloff last summer (from looming cuts to “higher for longer”), the shift in Q1 largely just reflected a delay in the timing. Indeed, central banks globally have signaled that no further rate hikes are expected and that their focus has shifted to the appropriate timing of cuts. Therefore, it remains the case that the path of least resistance for rates is lower, just not as quickly as previously anticipated.

Looking forward, the adjustment of expectations over the last three months brings the market more closely aligned with the views of central banks, which leads to a better balance of risks than prevailed three months ago. However, there is the potential that continued underlying economic strength could pave the way for a more extended pause that would limit downside for rates and weigh on the performance of bonds.

Market Indices Performance

Source: Bloomberg; All figures stated in Canadian dollars

*As of March 31, 2024

Commentary

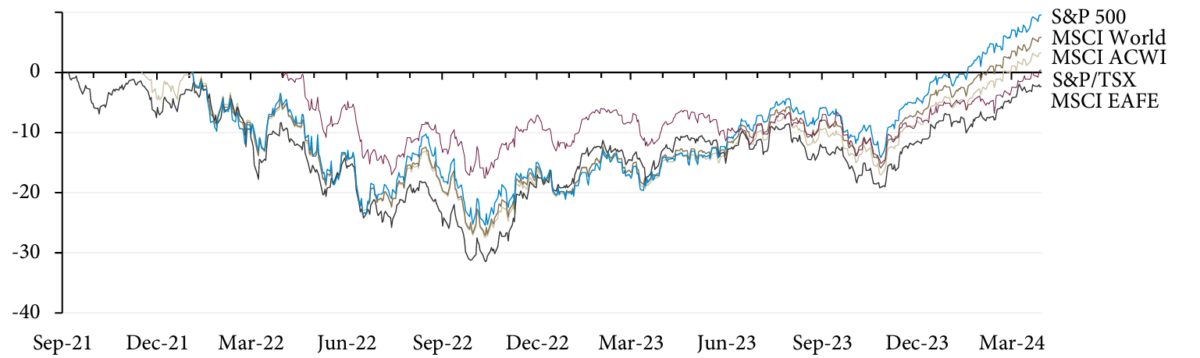

Equity markets are off to a good start this year, with stocks globally continuing to ride the momentum that began in earnest at the end of 2023. All major DM benchmarks have managed to set new all-time highs in the last three months, except the MSCI EAFE Index (which remains 2% below its prior peak hit on September 6, 2021) — the broad MSCI World Index has set 14 record high closes to the end of March, while the American S&P 500 has set 23; the domestic S&P/TSX Composite Index eclipsed its previous high (set on April 4, 2022) on March 21 and set three more new highs since.

Started from the bottom, now we’re here…

(percent from the previous peak; local currency basis)

Source: Guardian Capital based on daily data from Bloomberg to March 29, 2024

While this is positive for investors’ portfolios, reaching new heights tends to bring about a rise in anxieties — after all, when you are at the top, there is seemingly nowhere to go but down.

This is especially the case when the moves have been as rapid and largely one-directional as those experienced over the last five months and have been accompanied by a rise in investor sentiment that has pushed valuation metrics into rarefied air, raising the spectre of asset bubbles past.

Paying attention to potential downsides is always valuable when it comes to managing investments, and while concerns cannot be dismissed, it is worth highlighting some current mitigating factors.

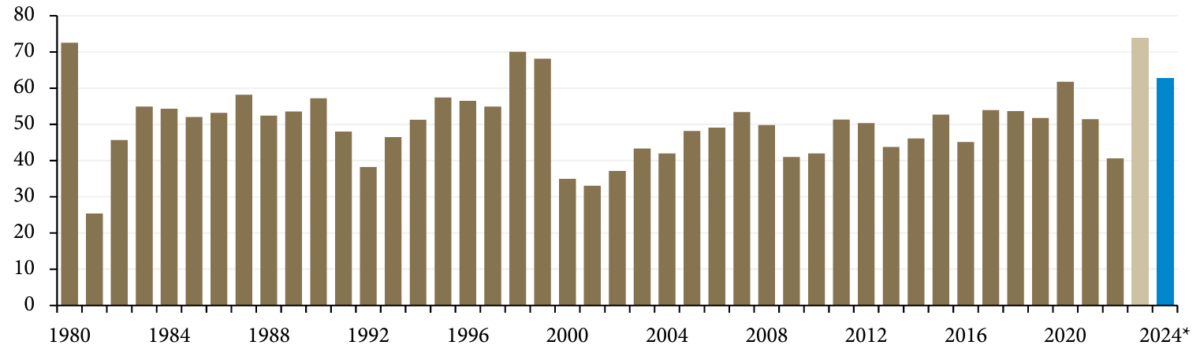

For starters, not all stocks have benefitted from the improvement in investor enthusiasm. Instead, it has been a historically narrow subset of stocks associated with one subsector of technology (artificial intelligence) that has done the bulk of the heavy lifting. Performance elsewhere has been comparatively middling.

A good example of this fact is that nearly three-quarters of the constituent stocks that make up the S&P 500 underperformed the index in 2023 — a record going back four decades. Year to date we have seen the beginnings of a broadening out of the market, with the underperformers dropping to about 65%.

Gasping for breadth

(share of S&P 500 stocks underperforming the index; percent)

*2024 is year-to-March 29, 2024; source: Guardian Capital based on data from Bloomberg

In other words, broad market valuation metrics may not be overly representative of the “average” stock as they are skewed by the significant outperformance of a small number of stocks.

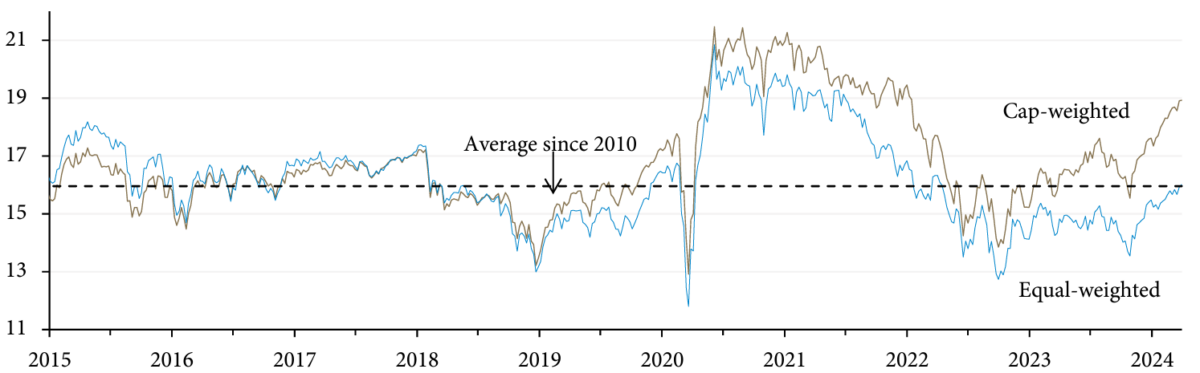

Further to this point, the equal-weighted version of the MSCI World Index is trading just a hair below the long-term average, while the price-to-earnings ratio for the market-capitalization-weighted MSCI World Index points to the broad Developed Market equity universe trading at a valuation that is more than one standard deviation above its average (and therefore on the expensive side of history).

Moving averages

(MSCI World Index forward price-to-earnings ratio; ratio)

Source: Guardian Capital based data from Bloomberg to March 29, 2024

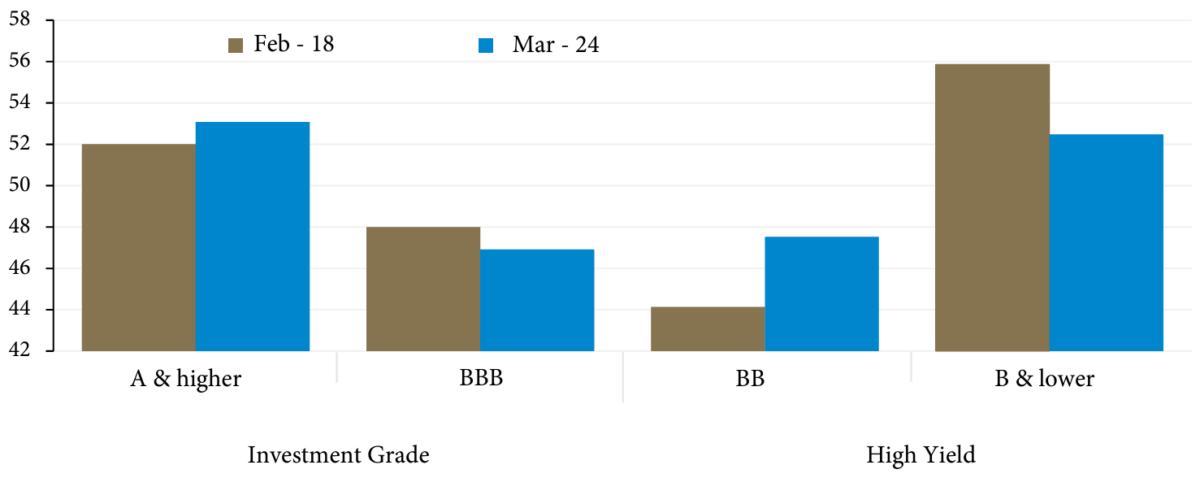

In a similar vein, while it is a fact that credit spreads for investment and non-investment grade (High Yield) bond indexes are near their historical lows — which could suggest stretched valuations — there is considerable dispersion under the hood.

In particular, the lowest quality credits (those rated “CCC” or lower by rating agencies) have seen their option-adjusted yield spreads over government bonds widen this year while all others have narrowed by a comparable degree. Also of note, these low-quality bond issues make up a lower share of the Bloomberg US Corporate Bond Index than they did last time aggregate spreads were at comparable levels back in February 2018. Credit quality in bond indices has improved across the board with the highest-rated credits in each aggregate now accounting for a greater weight than was the case six years ago. This fact alone would mean lower average spreads at the index level.

Moving averages

(share of total market value in Bloomberg US Corporate Bond Index; percent)

Source: Guardian Capital based data from Bloomberg to March 29, 2024

In essence, while there may be signs of froth in the marketplace, it is not the case that investors are passively chasing gains or that euphoria has made the whole market frothy and prone to an imminent correction. Instead, indications of discernment in the marketplace present opportunities for more active and selective investors. Add to this, the fact that clouds over the economic outlook appear to be parting with rising confidence in the forecast for what lies ahead and the potential for investors to continue enjoying the view from the top in the months to come.

The opinions expressed are as of the published date and are subject to change without notice. Assumptions, opinions and estimates are provided for illustrative purposes only and are subject to significant limitations. Reliance upon this information is at the sole discretion of the reader. This document includes information and commentary concerning financial markets that was developed at a particular point in time. This information and commentary are subject to change at any time, without notice, and without update. This commentary may also include forward-looking statements concerning anticipated results, circumstances, and expectations regarding future events. Forward-looking statements require assumptions to be made and are, therefore, subject to inherent risks and uncertainties. There is significant risk that predictions and other forward-looking statements will not prove to be accurate. Investing involves risk. Equity markets are volatile and will increase and decrease in response to economic, political, regulatory and other developments. Investments in foreign securities involve certain risks that differ from the risks of investing in domestic securities. Adverse political, economic, social or other conditions in a foreign country may make the stocks of that country difficult or impossible to sell. It is more difficult to obtain reliable information about some foreign securities. The costs of investing in some foreign markets may be higher than investing in domestic markets. Investments in foreign securities also are subject to currency fluctuations. The risks and potential rewards are usually greater for small companies and companies located in emerging markets. Bond markets and fixed-income securities are sensitive to interest rate movements. Inflation, credit and default risks are also associated with fixed income securities. Diversification may not protect against market risk, and loss of principal may result. This commentary is provided for educational purposes only. It is not offered as investment advice and does not account for individual investment objectives, risk tolerance, financial situation or the timing of any transaction in any specific security or asset class. Certain information contained in this document has been obtained from external parties, which we believe to be reliable, however, we cannot guarantee its accuracy. These sources include Bloomberg, Bank of Canada and National Bank Independent Network for the relevant periods cited in this commentary. Guardian Capital Advisors LP provides private client investment services and is an indirect wholly owned subsidiary of Guardian Capital Group Limited, a publicly traded firm listed on the Toronto Stock Exchange. All trademarks, registered and unregistered, are owned by Guardian Capital Group Limited and are used under license.