Equities

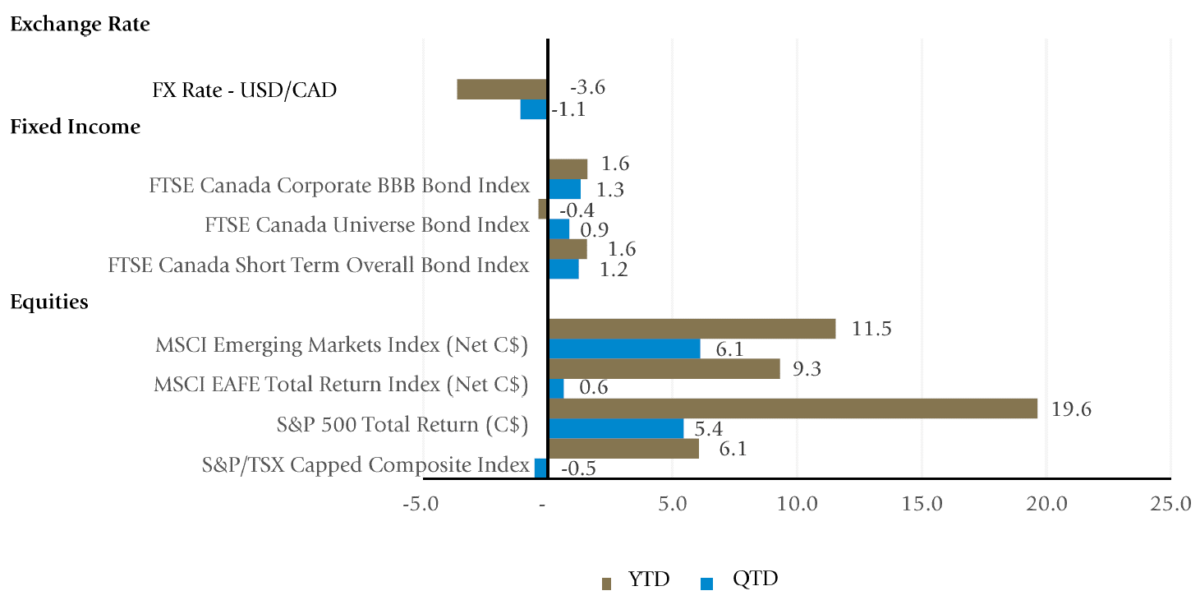

After a lengthy upswing over 2023 and early 2024, the complexion of Developed Market (DM) equities during the second quarter was decidedly more mixed. Large US corporations with strong growth prospects remained popular, with shares of major companies in the Information Technology and Communication Services sectors propelling the S&P 500 Index to a +5.4% gain in Canadian dollar terms. The overall gain, however, masks the lesser performance of many other parts of the market, as eight of 11 industry sectors fell short of the average, and within this, five sectors declined in value. The divergence reveals the popularity of the relatively small slice of stocks that look to be artificial intelligence winners, and a level of current disinterest for most everything else.

Without the benefit of a comparably large Technology cohort, returns in Europe and Asia were weak, with the MSCI EAFE Index seeing more tepid, 0.7% gains in Canadian dollar terms over the quarter. An additional influence here was a surprise snap election called in France, where the possibility of a free-spending ruling party weighed on share prices. The domestic S&P/TSX Composite Index was sluggish, falling 0.5% in the quarter, with strength in gold mining stocks the only real bright spot in an otherwise lacklustre market that saw seven of 11 sectors declining in price.

A possible change of tone in security markets this quarter deserves consideration, with interest rate cuts from central banks in Sweden, Switzerland, Canada and the European Central Bank perhaps confirming that inflationary pressures may now be under control. At the same time, share price weakness in a variety of cyclical groups, such as transportation and consumer stocks, suggests that some economic momentum in North America could be waning, adding to more longstanding news reflecting a slowing Chinese economy. More positively, share valuations for many leading corporations in Canada, the United States, Europe and Asia now look to offer compelling entry points for investors after the price declines seen in recent months. Performance over the remainder of 2024 should reflect a balance of these factors, as investors digest the outlook for elections in the US and Europe, the resiliency of consumer demand and corporate profit growth trends in the context of very reasonable valuations across much of the stock market.

Fixed Income

Bond markets rebounded from a weak start to the year, with central banks in Europe and Canada beginning their widely anticipated moves back toward a more “neutral” policy stance. There are continued indications that others (including the US Federal Reserve) will follow suit sooner rather than later, which is providing a tailwind for fixed income securities that have been battered over the last two years.

The downward pressure on market interest rates, however, was largely concentrated at the front end of the yield curve with rates on longer term-to-maturity bonds ending the quarter roughly where they began. The net result was that while performance across fixed income markets was broadly positive for the quarter (the domestic benchmark FTSE Canada Universe Bond Indexwas up 0.9% and all major sub-components finished in the green), shorter duration bonds (FTSE Canada Short Term Index +1.2%) notably outperformed their longer duration counterparts (FTSE Canada Long Term Index +0.2%) for the three months ended June 30, 2024. Corporate bonds (FTSE Canada All Corporate Bond Index +1.1%) also fared marginally better than government bonds in the period (FTSE Canada All Government Bond Index +0.8%).

Further rate cuts from central banks in the months ahead would be supportive of further bond performance while rising geopolitical tensions and the looming US election could spur market volatility that could drive investor demand for the safe, income-generating asset class that offers among its best risk/reward profiles in decades.

Market Indices Performance (as at June 30, 2024)

Source Bloomberg: All figures stated in Canadian dollars as at June 30, 2024

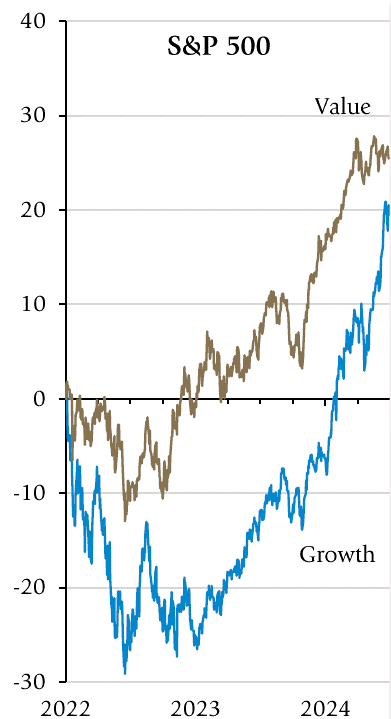

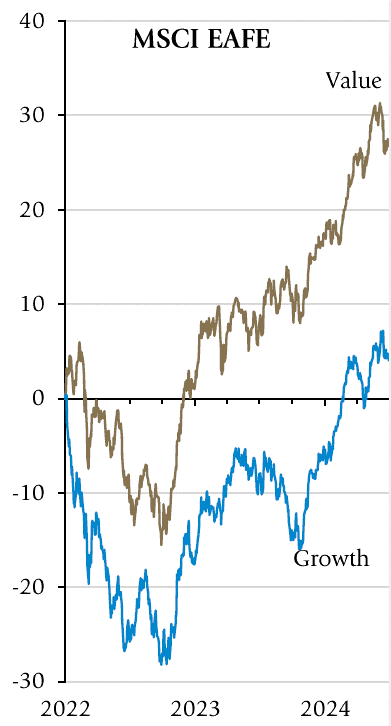

For the third straight quarter, and the fifth time in the last six, the more “growth”-oriented segments of global stock markets outperformed their “value”-biased peers and by a wide margin. The MSCI World Growth Index generated a +7.4% total return (Canadian dollar basis) over the three months ended June 30, 2024, which handily beat the 0.2% decline in the MSCI World Value Index over the same period.

Since the start of 2023, the MSCI World Index’s “value” stocks have trailed their “growth” counterparts by a whopping 43 percentage points (+20% versus +63%, respectively; the MSCI World is up 40% over that span), leading many investors to begin to offload these positions in favour of chasing the performance seen elsewhere.

Such a move to reduce the diversity of investment styles in investors’ portfolios, however, may well prove short-sighted.

Growth strategies — especially those with a focus on the US and its narrow subset of high-flying artificial intelligence-adjacent stocks — have outperformed materially over the last year and a half as markets have persistently marched up to new record highs, however, they tend to fare much worse in more challenging market environments. For example, amid the broad market weakness throughout 2022, the MSCI World Growth Index fell 24%, materially lagging the flat return for the value index (and the mere 12% decline in the broad MSCI World Index for the year).

This type of downside protection is highly important with respect to building wealth in the longer term since the comparatively limited impairment of capital in a downturn means that subsequent rebounds are applied to a larger base and can result in outperformance across full market cycles. Case in point, the better relative performance throughout the tumultuous 2022 has meant that value has actually outperformed growth since the end of 2021 despite the comparatively lacklustre returns over the last year-and-a-half — as the charts below show. That goes for all regions, including the US, though the performance gap is smaller than in Europe, Australasia and the Far East (EAFE) and Canada.

Surprisingly better value

(percent change from December 31, 2021; Canadian dollar total return basis)

Source: Guardian Capital based on daily data from Bloomberg to June 28, 2024

Markets ebb and flow as the macroeconomic, fiscal, monetary, and geopolitical backdrop changes, with different asset classes and investment strategies falling into and out of favour over time. As such, while there can be the compulsion to follow hot investment trends, it remains prudent for investors to maintain a disciplined, long-term focus, taking advantage of opportunities to add to high-quality investments that trade at attractive valuations to well-diversified portfolios, which are designed to mitigate risk in order to generate wealth over time.

All returns are stated in Canadian dollar terms unless indicated otherwise.

The opinions expressed are as of the published date and are subject to change without notice. Assumptions, opinions and estimates are provided for illustrative purposes only and are subject to significant limitations. Reliance upon this information is at the sole discretion of the reader. This document includes information and commentary concerning financial markets that was developed at a particular point in time. This information and commentary are subject to change at any time, without notice, and without update. This commentary may also include forward-looking statements concerning anticipated results, circumstances, and expectations regarding future events. Forward-looking statements require assumptions to be made and are, therefore, subject to inherent risks and uncertainties. There is significant risk that predictions and other forward-looking statements will not prove to be accurate. Investing involves risk. Equity markets are volatile and will increase and decrease in response to economic, political, regulatory and other developments. Investments in foreign securities involve certain risks that differ from the risks of investing in domestic securities. Adverse political, economic, social or other conditions in a foreign country may make the stocks of that country difficult or impossible to sell. It is more difficult to obtain reliable information about some foreign securities. The costs of investing in some foreign markets may be higher than investing in domestic markets. Investments in foreign securities also are subject to currency fluctuations. The risks and potential rewards are usually greater for small companies and companies located in emerging markets. Bond markets and fixed-income securities are sensitive to interest rate movements. Inflation, credit and default risks are also associated with fixed income securities. Diversification may not protect against market risk, and loss of principal may result. This commentary is provided for educational purposes only. It is not offered as investment advice and does not account for individual investment objectives, risk tolerance, financial situation or the timing of any transaction in any specific security or asset class. Certain information contained in this document has been obtained from external parties, which we believe to be reliable, however, we cannot guarantee its accuracy. These sources include Bloomberg, Bank of Canada and National Bank Independent Network for the relevant periods cited in this commentary. Guardian Capital Advisors LP provides private client investment services and is an indirect wholly owned subsidiary of Guardian Capital Group Limited, a publicly traded firm listed on the Toronto Stock Exchange. All trademarks, registered and unregistered, are owned by Guardian Capital Group Limited and are used under license.